Investors lock gaze on US inflation data

BTC/USD

+0.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Dollar trades cautiously ahead of inflation numbers

- Yen pulls back on Ueda’s and Suzuki’s remarks

- Pound retreats but BoE still expected to cut rates after Fed

- S&P 500 and Nasdaq slide, Bitcoin hits new record high

Dollar looks for direction in CPI data

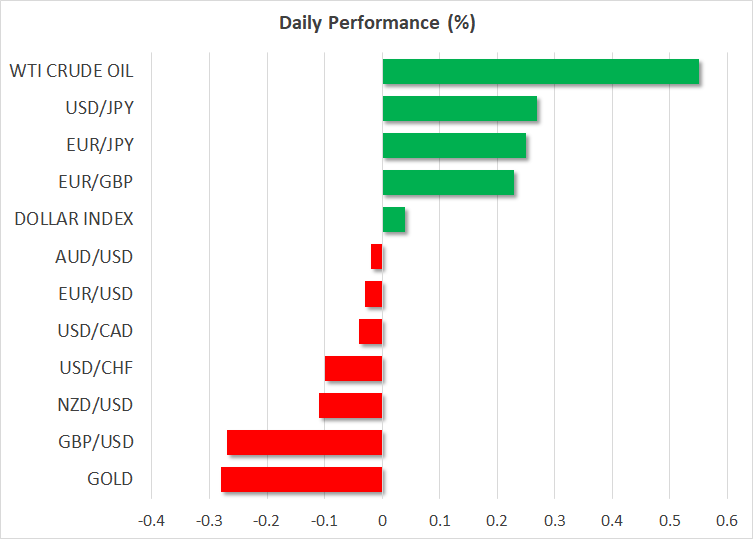

The US dollar traded higher against most of the other major currencies on Monday, but it is trading more cautiously today, recording noticeable gains only against the yen and the pound.

It seems that trading is more careful today as market participants are awaiting the US CPI data that may add more clarity on when the Fed may begin lowering interest rates. Following the disappointing ISM PMIs, Fed Chair Powell’s more-dovish-than-expected testimony last week, and Friday’s jobs report that pointed to further cooling in the US labor market, investors are penciling in 90bps worth of rate reductions by the end of the year, assigning a more than 80% chance for a first quarter-point cut to be delivered in June.

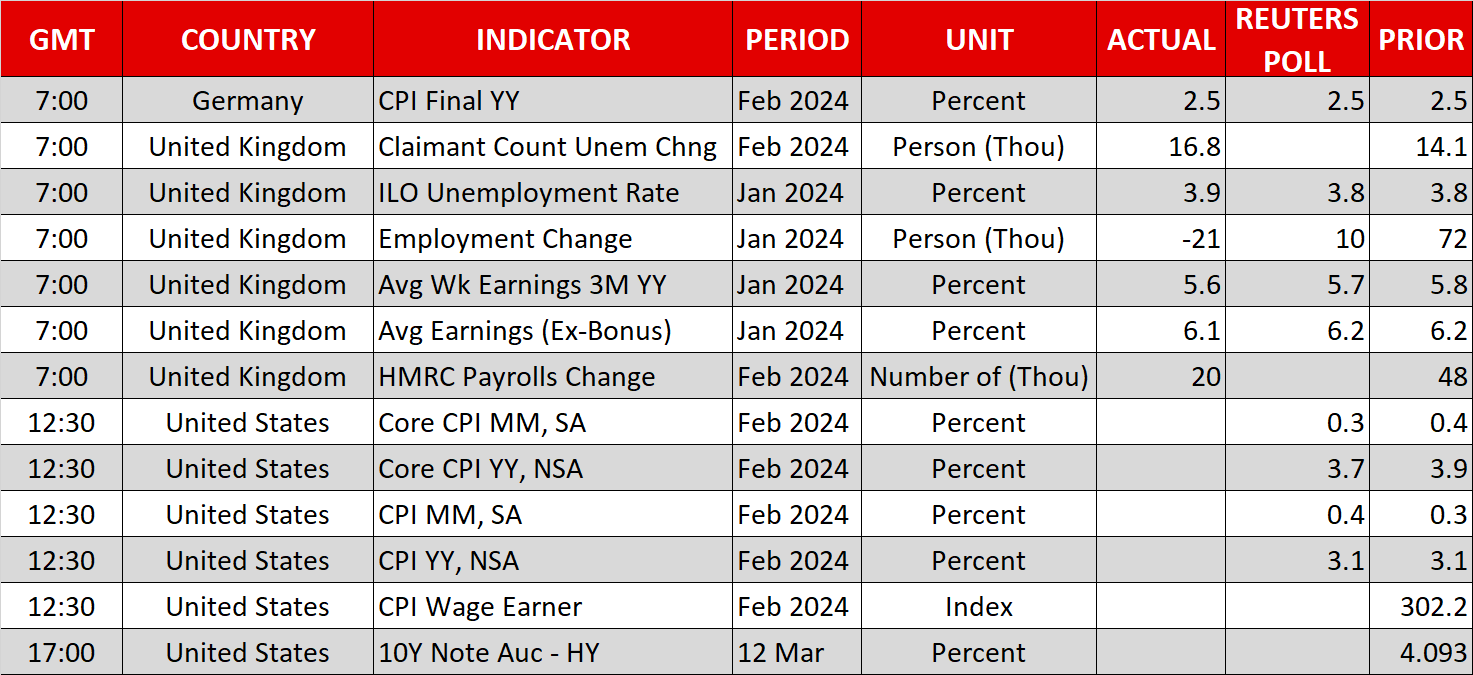

The forecasts for today’s data suggest that the headline CPI rate remained unchanged at 3.1% y/y in February and that the core one slid to 3.7% y/y from 3.9%. According to both the ISM manufacturing and non-manufacturing PMIs, prices continued to increase in February, but at a slower pace than in January, corroborating the forecast for the core CPI rate, while the fact that the year-on-year change in oil prices turned somewhat positive lately, supports the notion for a sticky headline rate.

A sticky headline rate may initially support the dollar, but a further slowdown in underlying price pressures could allow investors to maintain bets about a June cut as it may add to Fed officials’ confidence that inflation continues to move towards their objective. Thus, the greenback may quickly give back any headline-related gains and resume its recent short-term downtrend.

Will the BoJ hike in March?

The yen gave back some of its latest gains today after BoJ Governor Ueda said that the Japanese economy is recovering but is still showing signs of weakness. Finance Minister Suzuki also stepped onto the rostrum, saying that they cannot declare deflation is beaten yet, despite some positive developments like high pay hikes.

The Japanese currency skyrocketed last week following several reports that the BoJ is getting closer to lifting interest rates out of negative territory as wage negotiations are set to conclude with another round of strong wage increases. Yesterday, a new report hit the wires saying that a growing number of policymakers are warming to the idea of ending negative interest rates next week, with the chance of such an action rising to 50%.

Despite the yen’s pullback on Ueda’s and Suzuki’s remarks today, that probability only slid to 47%, suggesting that traders remain willing to buy the yen again should new headlines point to an imminent hike.

Pound pulls back but BoE bets remain unaffected

The pound lost the most ground against the dollar yesterday and extended its slide today after the UK employment report revealed that the unemployment rate ticked up to 3.9% from 3.8% and that average weekly earnings slowed more than expected.

However, market participants did not bring forward their BoE rate cut bets. They still believe that the BoE will begin lowering interest rates in August, after the Fed and the ECB. The pound’s retreat yesterday may have just been the result of reduced risk appetite.

Stocks lose steam ahead of CPIs, Bitcoin hits new record

Speaking about risk appetite, on Wall Street, although the Dow Jones gained some ground yesterday, both the S&P 500 and Nasdaq slid, with the latter losing the most. Following Friday’s disappointing US jobs data, equity investors may have been liquidating some of their positions, remaining unwilling to buy ahead of today’s inflation data.

Numbers suggesting progress in the Fed’s mission to bring inflation back to 2% could encourage another round of buying as expectations of lower interest rates are resulting in higher present values.

In the crypto world, Bitcoin hit a new record high on Monday after breaking above $72,000. Although the crypto king is back below that zone today, there are no convincing signals that the latest rally has reached an end. Bitcoin has been boosted by accelerating flows into the new spot bitcoin ETFs, but also due to a fear-of-missing-out (FOMO) response ahead of April’s halving, after which the supply of bitcoin is set to get tighter.