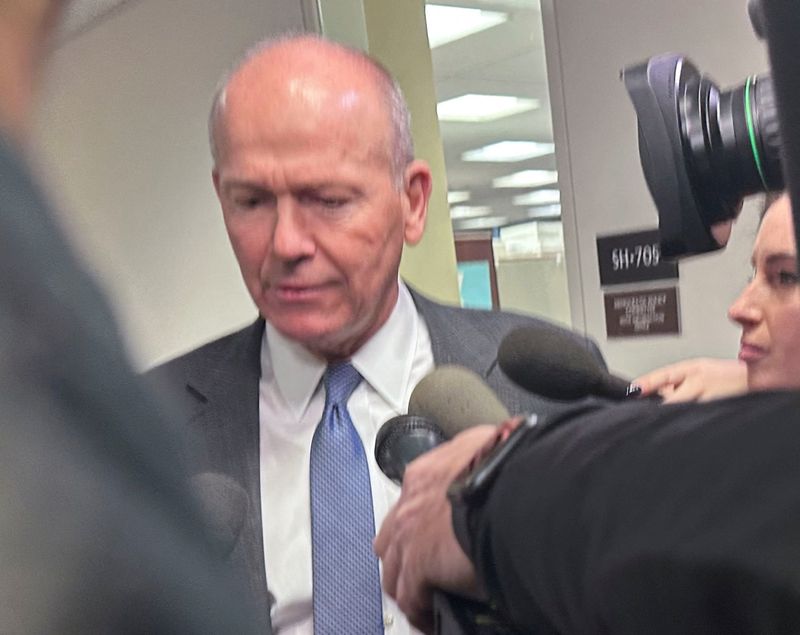

Boeing CEO Dave Calhoun to step down in shakeup amid safety crisis

FILE PHOTO: Boeing CEO Dave Calhoun speaks with reporters ahead of meeting with U.S. senators on Capitol Hill in Washington, U.S., January 24, 2024. REUTERS/Valerie Insinna/File Photo

BA

+1.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By David Shepardson and Allison Lampert

(Reuters) -Boeing CEO Dave Calhoun will step down by year-end in a broad management shakeup brought on by the planemaker’s sprawling safety crisis exacerbated by a January mid-air panel blowout on a 737 MAX plane.

Stan Deal, Boeing (NYSE:BA) Commercial Airplanes President and CEO, will retire, and Stephanie Pope will take over that business, the company said Thursday. Steve Mollenkopf, former CEO of tech company Qualcomm (NASDAQ:QCOM), has been appointed new chair of the board and is leading the search for the next CEO.

The leadership changes cap weeks of turmoil at Boeing, after the mid-air incident involving an Alaska Airlines-operated MAX 9 jet carrying 171 passengers turned into a full-blown safety and reputational crisis for the iconic planemaker.

Boeing shares have lost roughly one-quarter of their value since the incident. They were up 2.3% in early trading Monday.

The January incident was only the most recent in a series of safety crises that have shaken the industry’s confidence in the planemaker and hampered its ability to increase production. Calhoun himself was brought in as CEO following a pair of crashes in 2018 and 2019 that killed nearly 350 people.

Some investors expressed concern that this shake-up would not be enough to address these issues.

“We’ve long thought that the issues at Boeing have been seated in cultural challenges,” said Cameron Dawson, chief investment officer at NewEdge Wealth.

The company is facing heavy regulatory scrutiny and U.S. authorities curbed production while it attempts to fix its safety and quality problems. The company is in talks to buy its former subsidiary Spirit AeroSystems (NYSE:SPR) to try to get more control over its supply chain.

“Given the broad sweep here, big and overdue changes are likely,” said Boeing critic Richard Aboulafia.

QUESTIONS ABOUT MANAGEMENT

Last week, a group of U.S. airline CEOs sought meetings with Boeing directors without Calhoun to express concern over the Alaska Airlines accident, saying it was an unusual sign of frustration with the manufacturer’s problems and Calhoun.

Analysts and investors called the shakeup positive for Boeing, but stressed that much depends on Calhoun’s successor and changing the company’s culture from the top.

Some suggested Spirit AeroSystems CEO Patrick Shanahan, a former Boeing executive and U.S. government official, now tasked with a complex tie-up deal with the U.S. planemaker, as a possible successor to Calhoun, 66.

“We think it will require someone with pedigree and patience, as fixing Boeing is probably a multi-year non-linear journey,” said Vertical Research Partners aerospace analyst Robert Stallard, in a note to clients.

Following the incident, the FAA curbed Boeing production to a rate of 38 jets per month, but CFO Brian West said last week it had not even reached that figure.

Since Calhoun took the reins, the company has endured ongoing delays to production. Still, in October, Calhoun was upbeat over how fast Boeing could raise output of its the MAX jets, saying Boeing would get back to 38 jets a month and was “anxious to build from there as fast as we can.”

But weeks after the mid-air cabin panel blowout in January, Calhoun said it’s time to “go slow to go fast.”

The company’s crisis has frustrated airlines already struggling with delivery delays from both Boeing and its rival Airbus, and the planemaker has been burning more cash than expected in this quarter than expected.

“For years, we prioritized the movement of the airplane through the factory over getting it done right, and that’s got to change,” West said last week.

The company’s main rival, Airbus, clinched orders for 65 jets from two of Boeing’s key Asian customers recently, in what some saw as a sign of executives’ concerns about Boeing.