Dollar tumbles as Fed still sees three rate cuts this year

- Fed’s updated dot plot continues to suggest three rate cuts in 2024

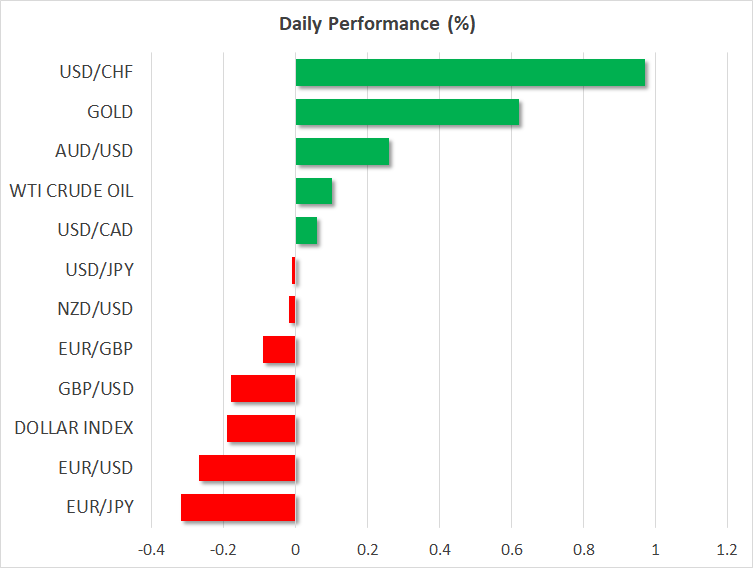

- Dollar tumbles across the board, June cut probability rises

- Pound traders lock gaze on BoE, SNB cuts interest rates

- S&P 500, Dow Jones and gold hit new record highs

Dollar falls on dovish Fed

The US dollar tumbled across the board on Wednesday after the Fed’s new projections revealed that officials are still expecting three quarter-point rate cuts in 2024.

The greenback has been in a recovery mode lately as data pointing to stickier-than-expected inflation and comments by a couple of Fed officials prompted investors to start speculating on the likelihood of an upside revision to the new dot plot to indicate only two reductions by December.

However, this was not the case despite the upgrades in growth and inflation forecasts. Officials just removed one quarter-point cut from their 2025 projections, while at the press conference following the decision, Fed Chair Powell said that recent high inflation readings had not changed the narrative of slowly easing price pressures.

The disappointment resulted in a weakening dollar and a retreat in Treasury yields, with market participants adding back to their rate cut bets. According to Fed funds futures, the probability of a first cut in June has risen to around 80%, with the total number of basis points worth of reductions expected by December increasing to 83.

Today, dollar traders may pay attention to the preliminary S&P Global PMIs for March. Expectations are for declines in both the manufacturing and services indices, something that may add validity to the market’s repricing following the Fed, and perhaps keep the dollar on the back foot.

Pound gains ahead of BoE, SNB cuts interest rates

The pound was among the main gainers yesterday, despite the UK CPI data for February revealing cooler than expected inflation in both headline and core terms. Perhaps Cable traders preferred to avoid largely adjusting their positions ahead of the Fed and BoE decisions.

The BoE meets today, and expectations are for policymakers to hold interest rates steady. So, with neither updated economic projections nor a press conference on today’s agenda, all the attention will fall on the accompanying statement and the meeting minutes on hints and clues on when policymakers may start lowering rates.

Should this Bank stay less dovish than the Fed, allowing investors to continue anticipating a first 25bps rate reduction in August, the pound may continue outperforming the dollar, with Cable perhaps returning above the 1.2800 barrier.

Ahead of the BoE, the Swiss National Bank (SNB) surprisingly cut interest rates by 25bps, noting that they will adjust monetary policy again if needed to ensure that inflation remains at levels consistent with medium-term price stability. The decision pushed the franc off the cliff.

The Eurozone PMIs were also released today, with the manufacturing index slipping further into contractionary territory, but the services index rising decently and driving the composite PMI higher, just a tick below the equilibrium zone of 50. The euro did not respond to the release as investors continued pricing in an 80% chance for the ECB to start cutting rates in June.

Yen takes a breather after Fed and Suzuki’s remarks

Although the Fed decision allowed the yen to recover some ground, dollar/yen closed the day in the green. However, the Japanese currency received an extra boost today after Japan’s finance minister Shunichi Suzuki said that the government is watching currency moves with “a high sense of urgency.”

That said, the price action suggests that yen sellers have not abandoned the game, and it will be very interesting to see whether they will be willing to push dollar/yen beyond the November highs and whether such a move will trigger actual intervention.

Wall Street rallies, gold marches to new record

On Wall Street, all three of its main indices closed well in the green, with the tech-heavy Nasdaq gaining the most, and the S&P 500 and the Dow Jones hitting fresh record highs. Usually, high-growth tech firms are valued by discounting free cash flows for the quarters and years ahead, and the Fed’s decision to continue pricing three rate cuts by December may have allowed present values to remain elevated.

With the market’s behavior suggesting that there may be more AI-related growth opportunities to be priced in, the Fed’s decision may allow equity traders to continue exploring uncharted territories.

Gold also benefited from the Fed’s decision to keep its rate projections for 2024 untouched, hitting a fresh record high at around $2,222. The next area to consider as a potential resistance barrier may be the 161.8% Fibonacci extension level of the May-October 2023 slide, at around $2,244.