Why Fed Still Expects to Cut Rates Despite Sticky Inflation

US2YT=X

+0.61%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The Federal Reserve lifted its outlook for core PCE inflation in 2024 but reaffirmed expectations that interest rates will probably fall by the end of the year. Despite the apparent conflict, the market quickly jumped on the bandwagon by bidding up bond prices (and lowering yields) and firming up expectations for rate cuts via the implied forecast in Fed funds futures.

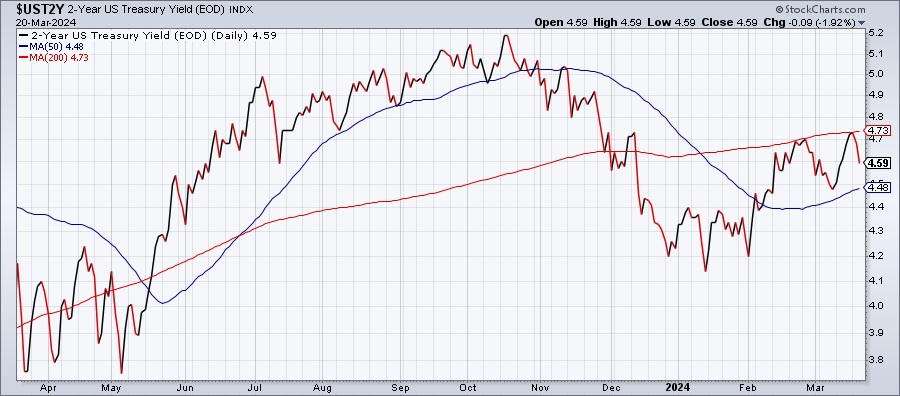

The policy-sensitive 2-year Treasury yield fell for a second day on Wednesday (Mar. 20), dropping to 4.59%, a middling level relative to the range of the past month. The latest decline coincided with yesterday’s widely anticipated Fed announcement that it would leave its target rate unchanged at a 5.25%-to-5.50% range.

US 2-Year Treasury Yield-Daily Chart

US 2-Year Treasury Yield-Daily Chart

The market’s main focus was on restated expectations that rate cuts are still on the table for later this year. Fed Chairman Powell remained cautious on the path ahead for monetary policy, advising:

“The risks are really two-sided here: We’re in a situation where if we ease too much or too soon, we could see inflation come back. If we ease too late, we could do unnecessary harm to employment.”

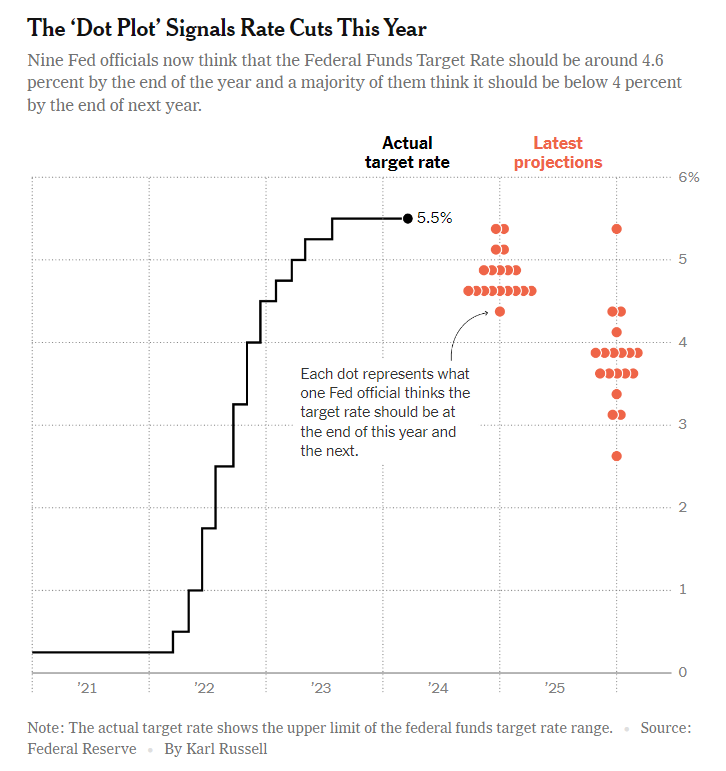

Nonetheless, revised expectations of Fed officials, summarized in the so-called dot plot chart shown below (courtesy of The New York Times), indicate that the central bank sees its target rate falling to roughly 4.6% by the end of 2024 from the current 5.25%-to-5.50% range.

Fed Dot Plot Chart

Fed Dot Plot Chart

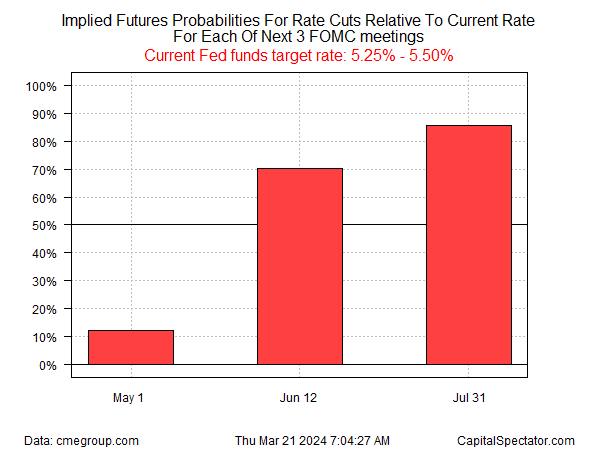

The Fed funds futures market lifted the estimated probability for the first rate cut in June to an implied 70%.

Fed Fund Futures

Fed Fund Futures

Despite the dovish bias, the Fed slightly raised its expectations for core PCE inflation this year to 2.6% from December’s 2.4% estimate. The central bank also increased its 2024 economic growth projection to 2.1% from the previous 1.4%, based on an annual GDP forecast.

Stronger growth and higher core inflation don’t immediately suggest a softer policy response, but Powell didn’t push back on the idea that the central bank would begin easing later in the year.

Yet the recent run of sticky inflation news leaves room for thinking that the Fed might have become more cautious about cutting rates in recent weeks. But as a reporter at The Wall Street Journal observes,

“Powell doesn’t seem so worried about the inflation reports this year.”

Despite the ongoing bias favoring rates cuts, the macro data still suggests that the timing for the start of policy easing could be delayed.

“There’s no urgency for them,” says Luke Tilley, chief economist at Wilmington Trust. “They’ve got a strong economy, strong labor market.”

Nonetheless, the crowd’s still expecting that June will mark the arrival of the first rate cut. The obvious caveat: A lot of economic data will be published between now and June and so it’s still an open debate if the incoming numbers will support the case for a June rate cut.