Meta Platforms: Is It Too Late to Buy the Stock After This Year’s 40% Rally?

META

+3.34%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Meta Platforms’ stock rose nearly 40% YTD, buoyed by impressive Q4 results, optimistic guidance, $50 billion share buyback, and a new dividend.

- Analysts increased EPS estimates for the next quarter by 74.9%, signaling high expectations.

- However, Fair Value estimates suggest the stock is slightly overpriced.

- Subscribe to InvestingPro for under $9 a month and get 70+ AI-powered market-beating stock picks every month!

Meta Platforms (NASDAQ:META) stock soared by over nearly 40% since the beginning of the year, boosted by strong Q4 earnings results in February, better-than-expected guidance for Q1/24, alongside the announcement of an additional $50 billion in share repurchases, and the introduction of its first-ever dividend.

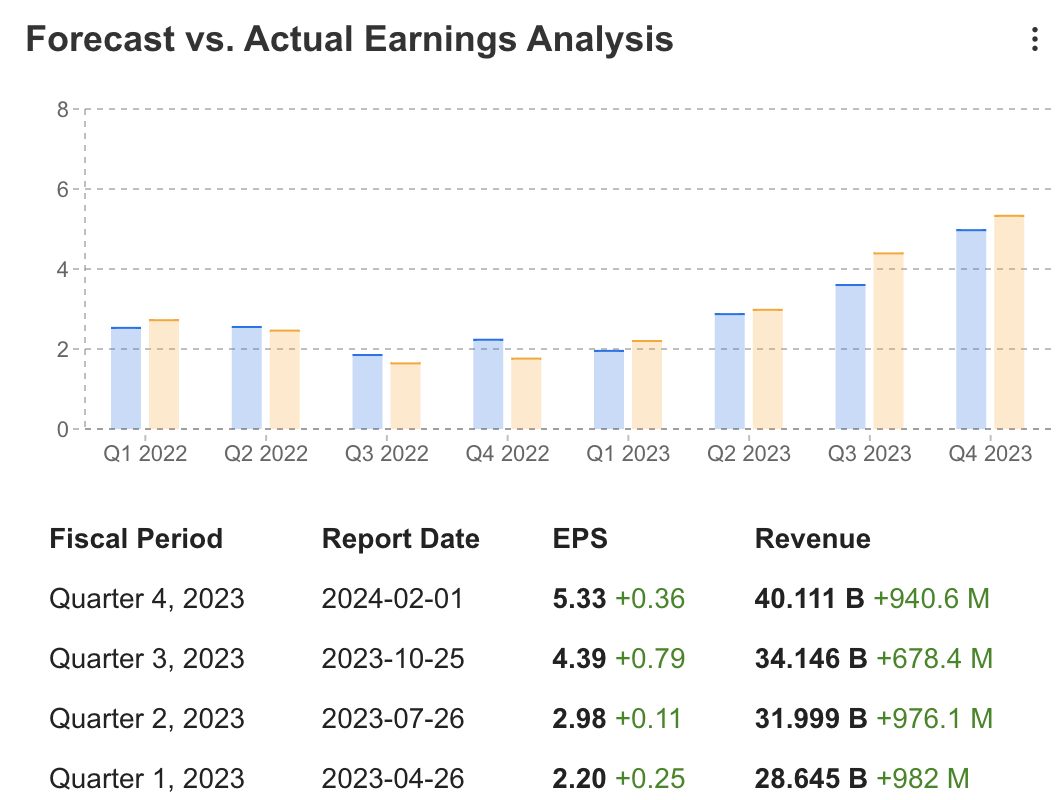

The rally comes on top of last year’s 194% gain – mostly thanks to ongoing strength in AI-driven digital advertising and increased operational efficiency, which helped the giant consistently outperform EPS and revenue forecasts over the past four quarters.

FB

FB

Wall Street analysts raised their EPS estimates for the upcoming quarter from $2.46 to $4.30 per share over the past 12 months, representing a substantial increase of 74.9%.

FB

FB

A closer look at Meta’s fundamentals

A review of the fundamentals, however, suggests that investors may be overly optimistic.

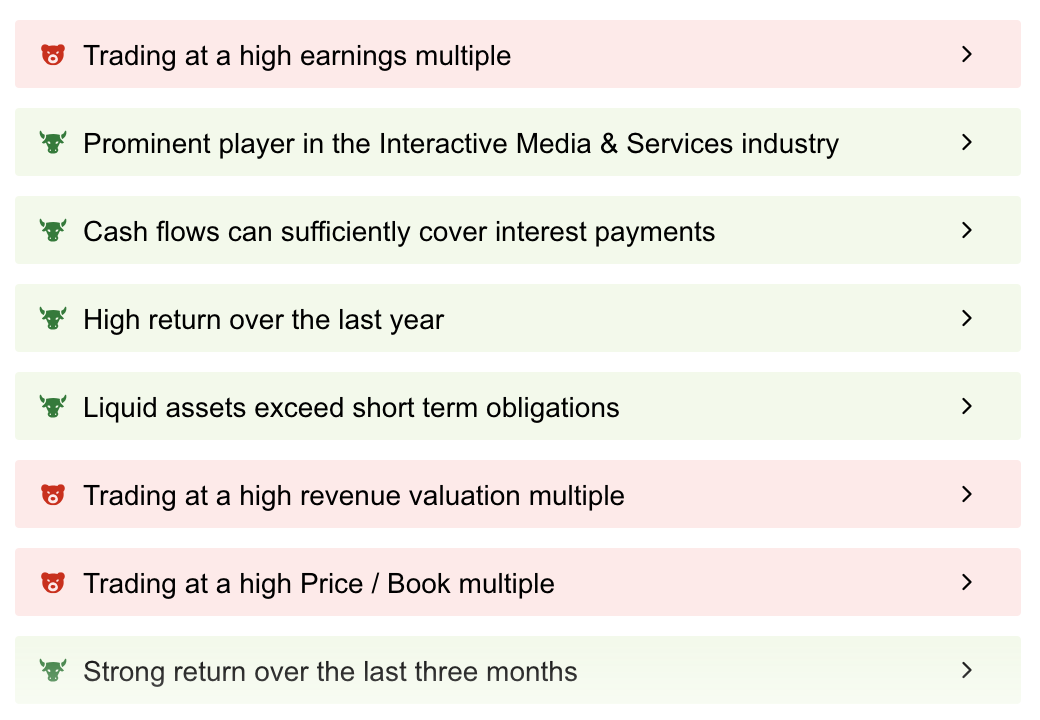

Our ProTips highlight Meta’s areas of concern alongside its strengths, pointing out issues such as its high earnings multiple, elevated revenue valuation multiple, and high price-to-book ratio.

FB

FB

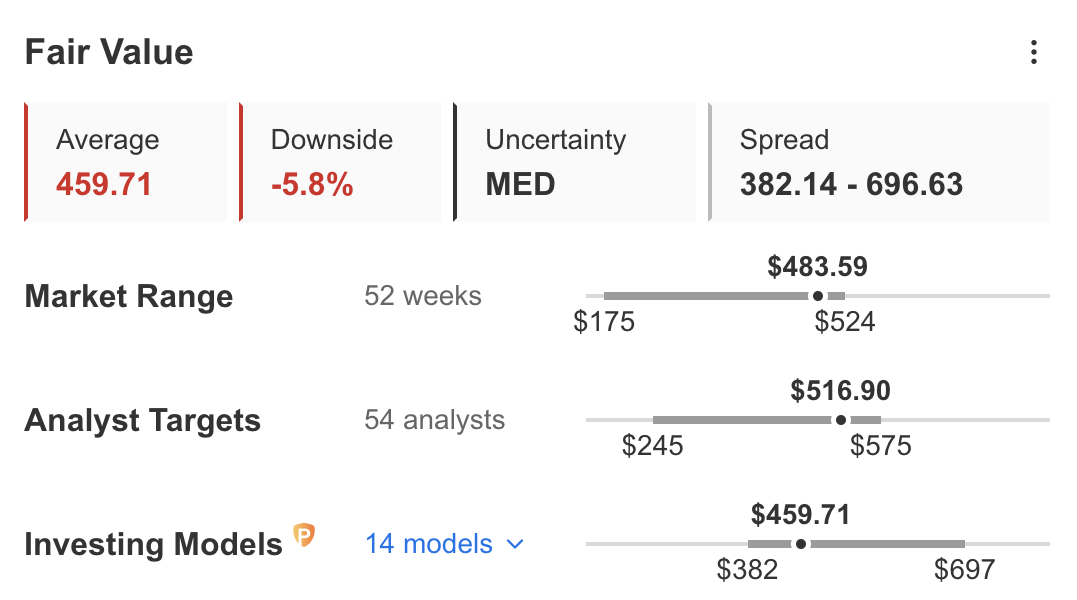

InvestingPro’s analysis on Fair Value anticipates a potential decline of 5.8% in Meta’s stock price. In contrast, Wall Street analysts are predicting a potential uptick of approximately 6.8%.

FB

FB

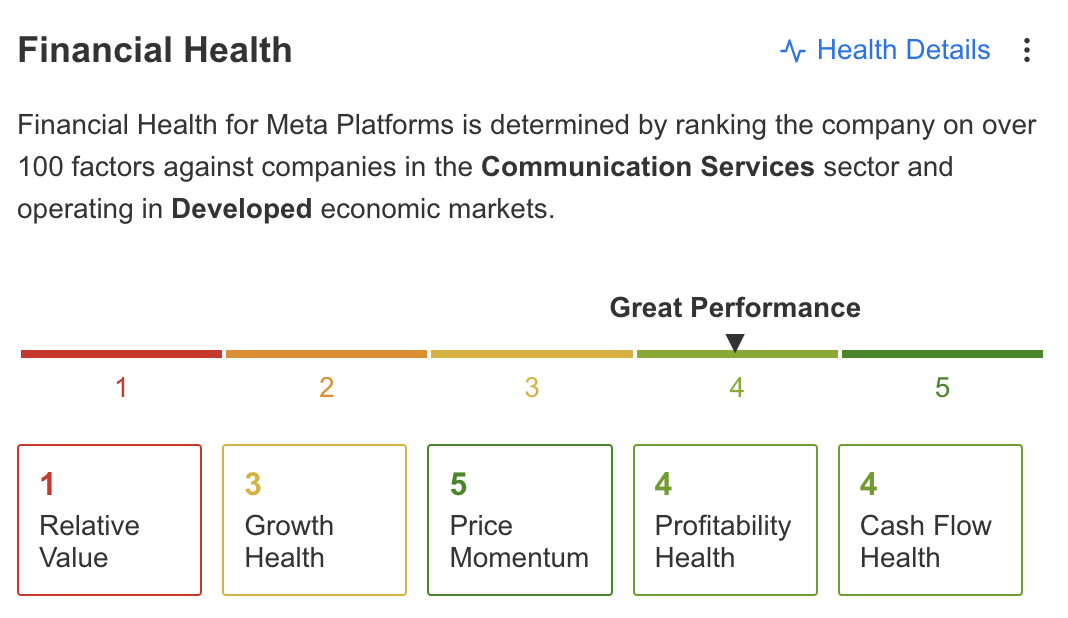

InvestingPro considers Meta’s financial health to be “Great”, which is determined by ranking the company on over 100 factors against companies in the Communication Services sector and operating in Developed economic markets.

FB

FB

Recent challenges

Recently, Meta faced challenges with Facebook’s Marketplace, as reported by The Wall Street Journal, highlighting user dissatisfaction due to counterfeit listings, fraud, and mismatches between product descriptions and received items.

Following the report, the company’s shares dropped more than 4% yesterday. Comments from former President Donald Trump, suggesting a TikTok ban would benefit Facebook, which he labeled an “enemy of the people,” have also negatively impacted the stock.

In summary, while Meta continues to benefit from advertising strength, concerns over valuation and recent developments suggest a cautious approach. Therefore, investors are advised to hold Meta shares until the upcoming earnings announcement on April 24 for further clarity.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

new year

new year

Disclaimer: