Nasdaq, S&P 500, Russell 2000 Sound ‘Bull Trap’ Alarm

US500

-1.02%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-0.99%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

-0.96%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

-1.65%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

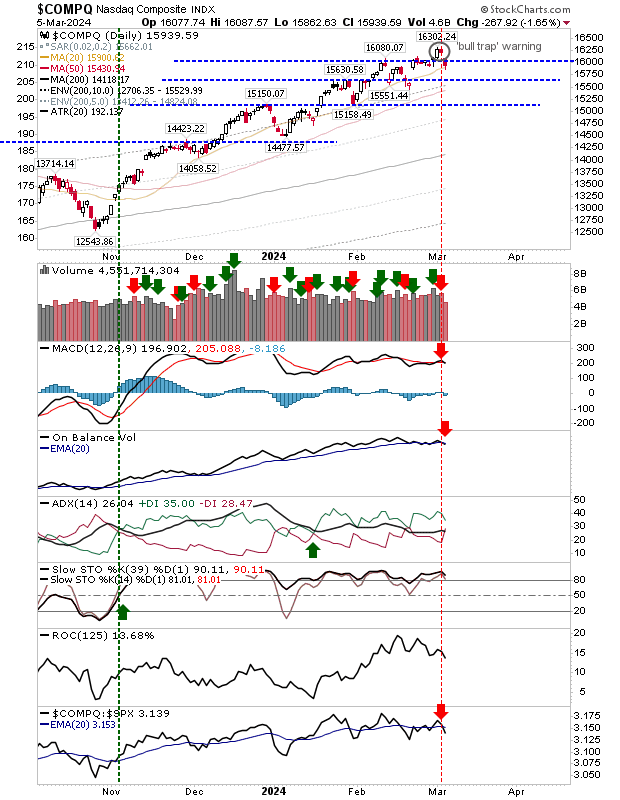

A couple of days ago we were looking at breakouts, now we need to be watchful for ‘bull traps’. We had the first triggers for one with the undercut of breakout support.

The next few days will be critical as to whether these undercuts end as ‘bull traps’, but for now, consider these short signals with stops above the breakout highs.

For the Nasdaq, the ‘bull trap’ came with ‘sell’ triggers in the MACD, On-Balance-Volume, and relative performance to the S&P 500.

COMPQ-Daily Chart

COMPQ-Daily Chart

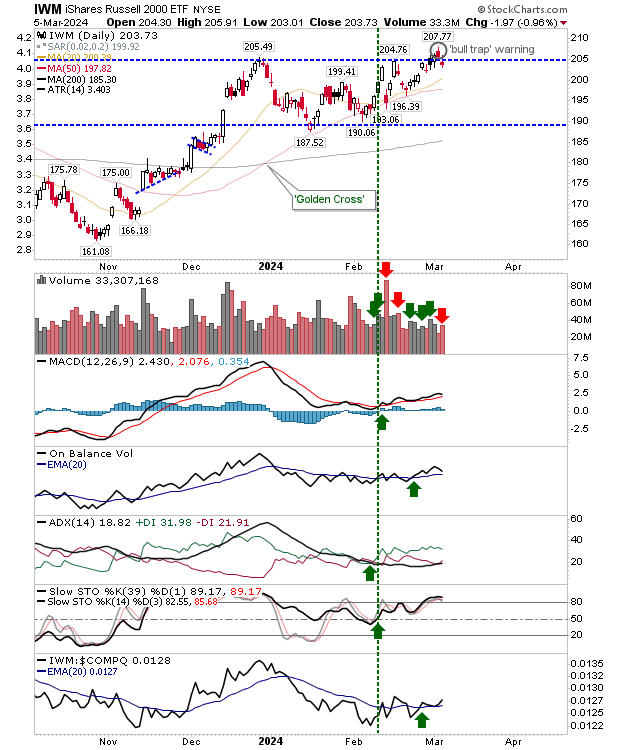

The Russell 2000 (IWM) didn’t suffer the same technical breakdown as the Nasdaq, but it did experience heavier volume distribution (although the volume itself wasn’t that heavy).

The index is still outperforming the Nasdaq and S&P 500 despite the loss.

IWM-Daily Chart

IWM-Daily Chart

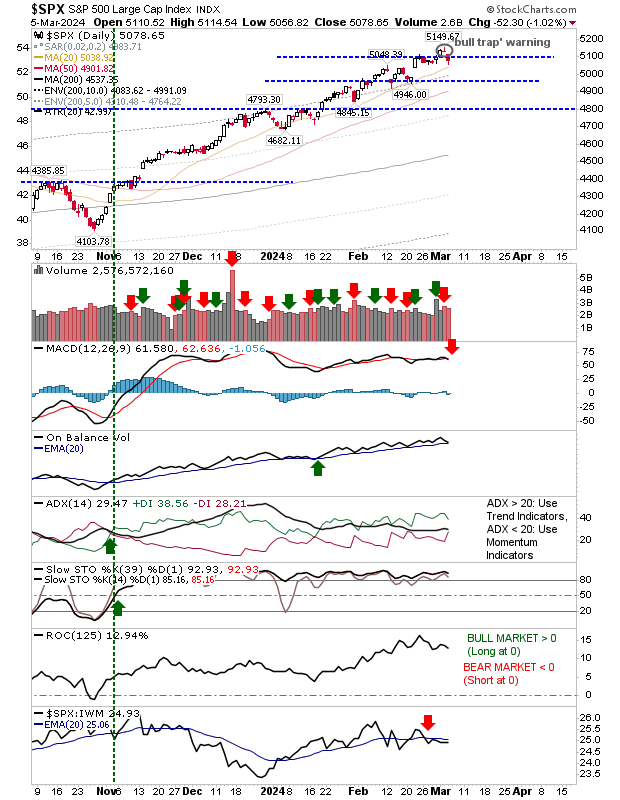

The S&P 500 is caught a little in the middle with a ‘sell’ trigger in a MACD that has effectively flatlined, but other technicals are still positive.

SPX-Daily Chart

SPX-Daily Chart

Up until now, rallies have been honoring support on subsequent tests. Yesterday marked the first real failing of such support.

However, there remains support to be found at 20-day MAs, and these moving averages are likely to see such tests today or Thursday at the latest.