2 Undervalued Mid-Cap Stocks to Own Amid Growing Rate Uncertainty

EEFT

-0.57%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

QDEL

-0.84%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Mid-cap stocks offer a balance of growth potential and stability between small and large caps.

- Among our picks in the cateogory, Euronet Worldwide and Quidel Corporation are highlighted as strong mid-cap companies with different growth paths.

- For under $9 a month using this link, you can receive the market’s top AI-selected stock picks every month!

Mid-cap stocks occupy a unique and often underrated position in the financial ecosystem, perfectly poised between the high-growth, high-risk profile of small-cap stocks and the well-established, less volatile nature of large-cap companies.

This middle ground offers investors an attractive blend of growth potential and stability—a combination that is hard to find in the more extreme ends of the market cap spectrum.

Investing.com’s flagship AI stock-picking tool offers you the best selection of mid caps in the market for less than $9 a month. Using state-of-the-art predictive AI technology, our Mid-Cap Movers strategy delivers you 15 monthly picks within the category for serious market outperformance.

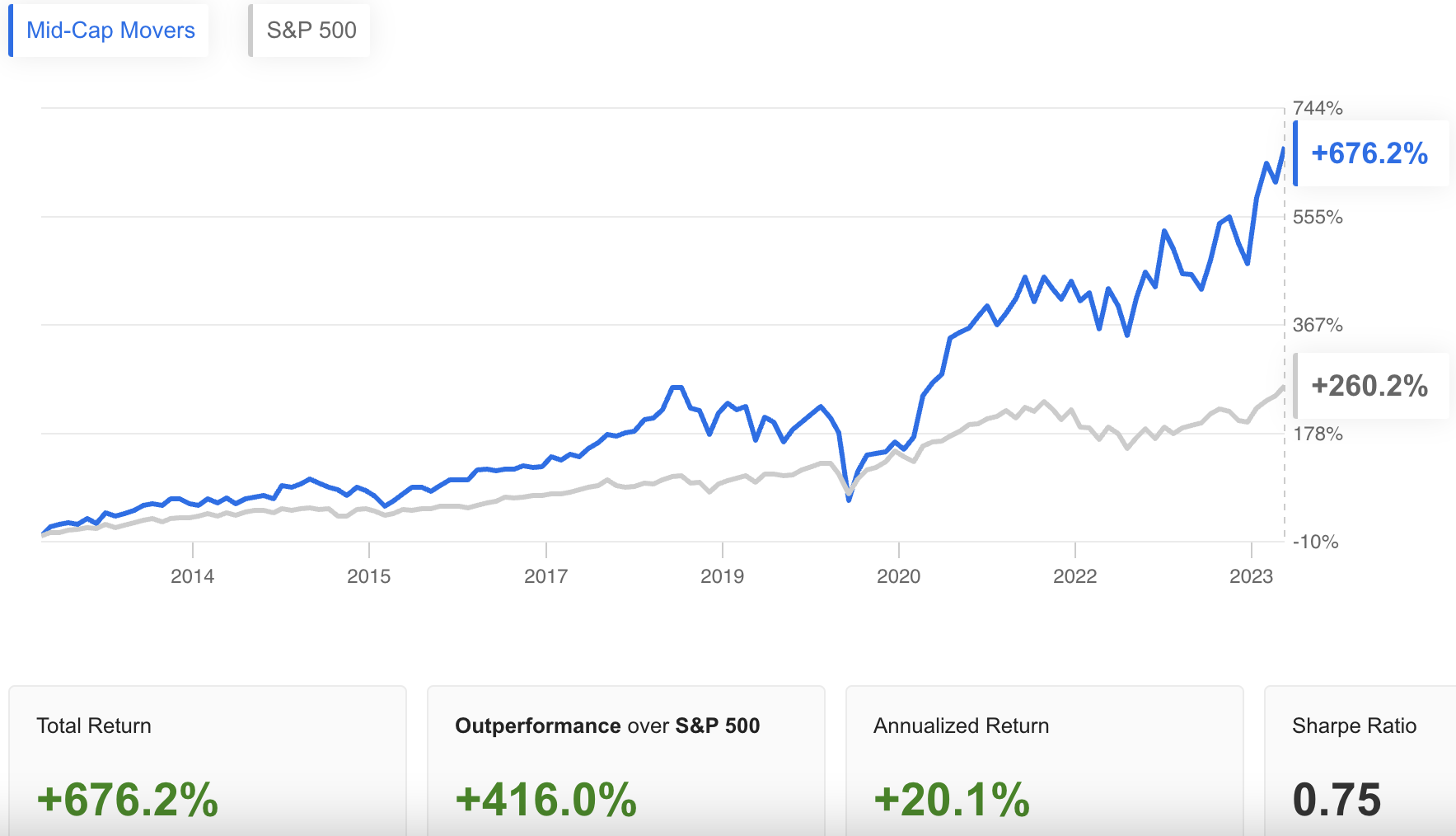

The results can be seen in the chart below: Mid-Cap Movers Vs. S&P 500

Mid-Cap Movers Vs. S&P 500

Now let’s take a look at two mid-cap companies poised for outperformance, namely Euronet Worldwide and Quidel Corporation. Each of these firms demonstrates strong fundamentals and growth prospects, yet they navigate different paths within the dynamic landscape of the stock market.

Subscribe here for under $9 a month to see all picks from our Mid-Cap Movers – as well as from our other 5 market-beating strategies.

Euronet Worldwide

Euronet Worldwide (NASDAQ:EEFT), a provider of transaction, payment processing, and distribution solutions globally, has outperformed EPS and revenue forecasts in the past two quarters, leading to a 40% rise in its stock price since October 2023.

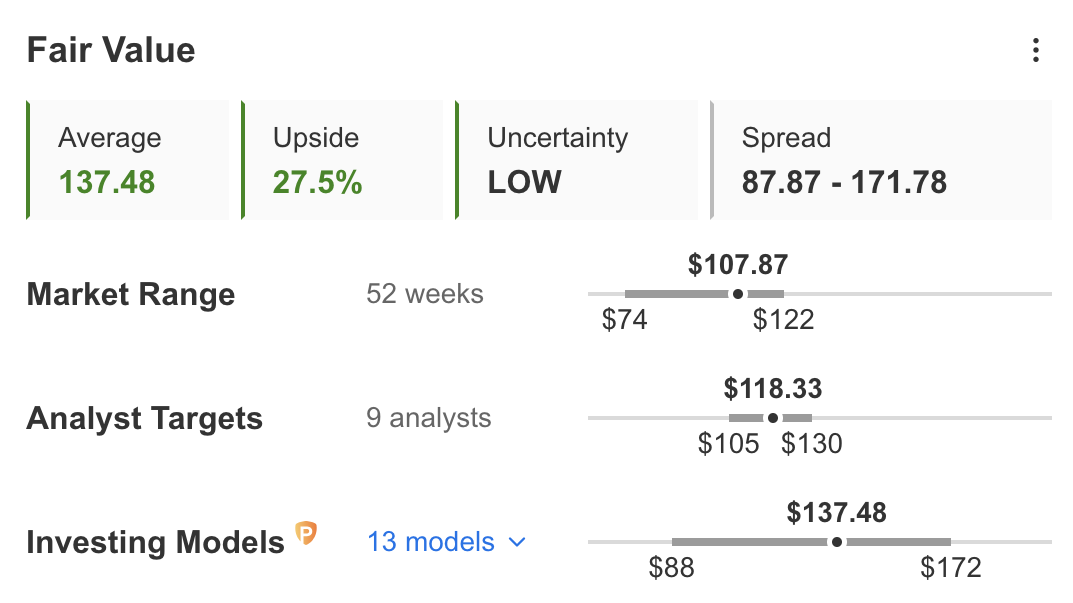

Despite this growth, InvestingPro’s Fair Value analysis indicates a further upside potential of 27.5%, compared to Wall Street analysts’ more conservative projection of nearly 10% growth.

EEFT

EEFT

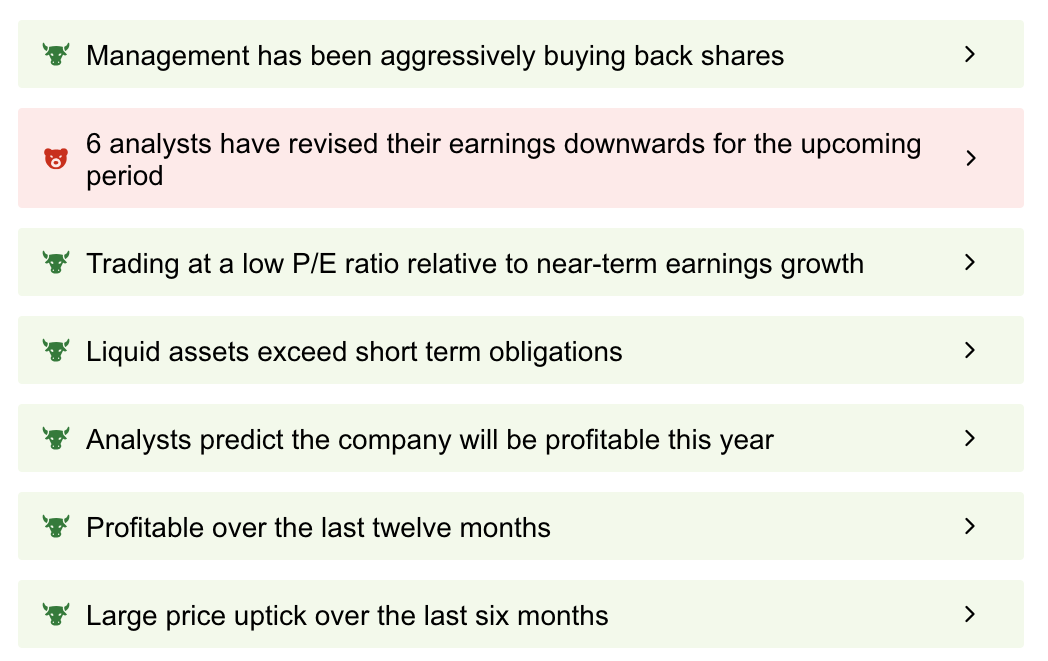

InvestingPro’s ProTips summary highlights Euronet Worldwide’s strengths, noting its aggressive share buyback strategy, attractive P/E ratio in light of expected near-term earnings growth, profitability over the previous year, and significant stock price increase over the last six months. The summary highlights a single point of concern: six analysts have lowered their earnings projections for the upcoming period.

EEFT

EEFT

The company’s EPS forecast trend shows analysts adjusting their expectations for the upcoming quarter, scheduled for April 30. Over the past 12 months, expectations have been adjusted from an EPS of 1.10 to 1.06, a decrease of 3.6%. In the past 90 days, two analysts have increased their EPS estimates, while three analysts have decreased theirs.

EEFT

EEFT

Following Euronet Worldwide’s strong Q4 earnings report in February, several Wall Street firms have updated their price targets for the company. Truist Securities increased its price target to $130.00 from $115.00 with a Buy rating, DA Davidson raised its target to $126.00 from $118.00, also recommending a Buy, and Needham upped its target to $120.00 from $115.00, maintaining a Buy rating.

Quidel

Quidel Corporation (NASDAQ:QDEL), a provider of diagnostic testing solutions, experienced a significant drop of 34% in its share price year-to-date, primarily due to its Q4 earnings falling short of expectations by a considerable margin, as reported in February. The company also provided guidance significantly below the market consensus. Following these results, the board of directors decided to terminate CEO Douglas Bryant, attributing the decision to the disappointing earnings performance.

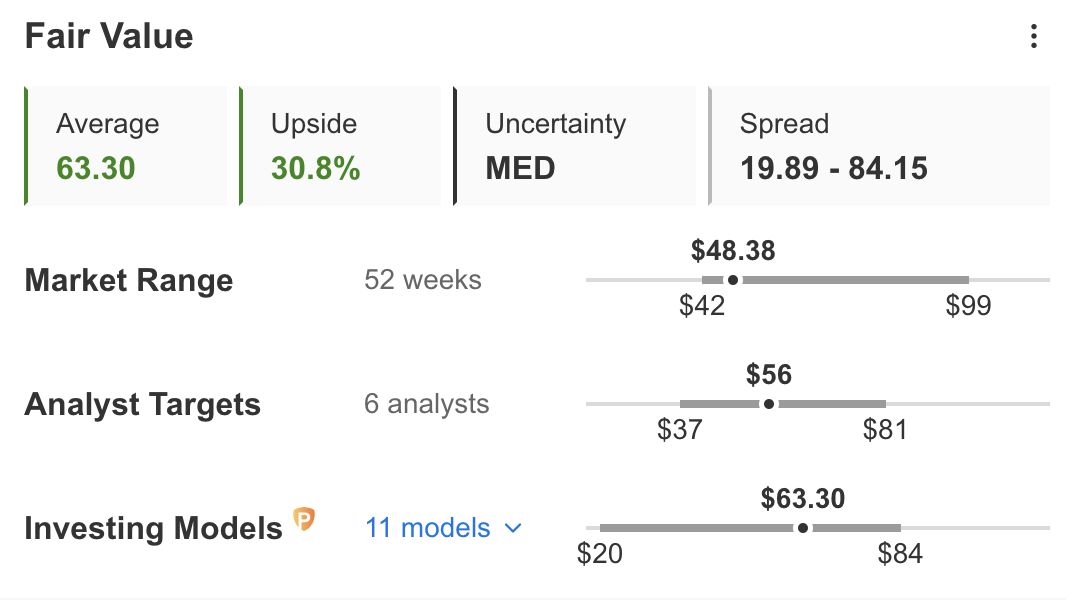

InvestingPro’s evaluation of the current fair value suggests that the stock is undervalued and has been excessively sold off. Investment models forecast a potential 30.8% rise in the stock price, contrasting with Wall Street analysts’ more conservative projection of approximately a 15.7% increase.

QDEL

QDEL

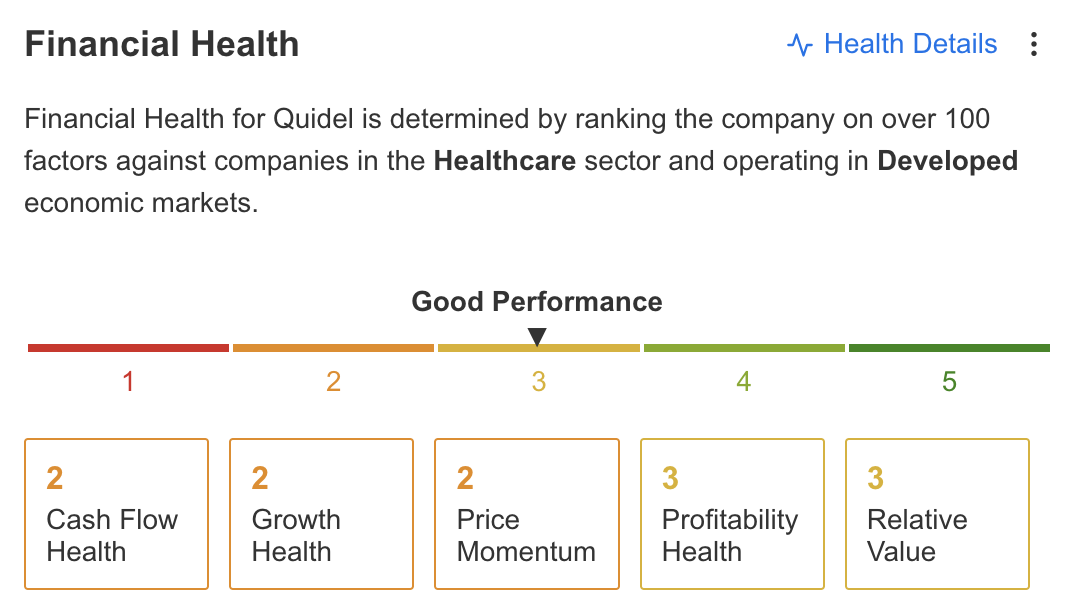

Moreover, InvestingPro rates Quidel Corporation’s financial health as “Good,” based on a comparison of over 100 factors against companies in the Healthcare sector and operating in Developed economic markets.

QDEL

QDEL

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

new year

new year

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.