Market Overview

S&P 500 E-Mini Breaks Out Above All-Time High

ESH24

-0.11%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Market Overview: S&P 500 Emini Futures

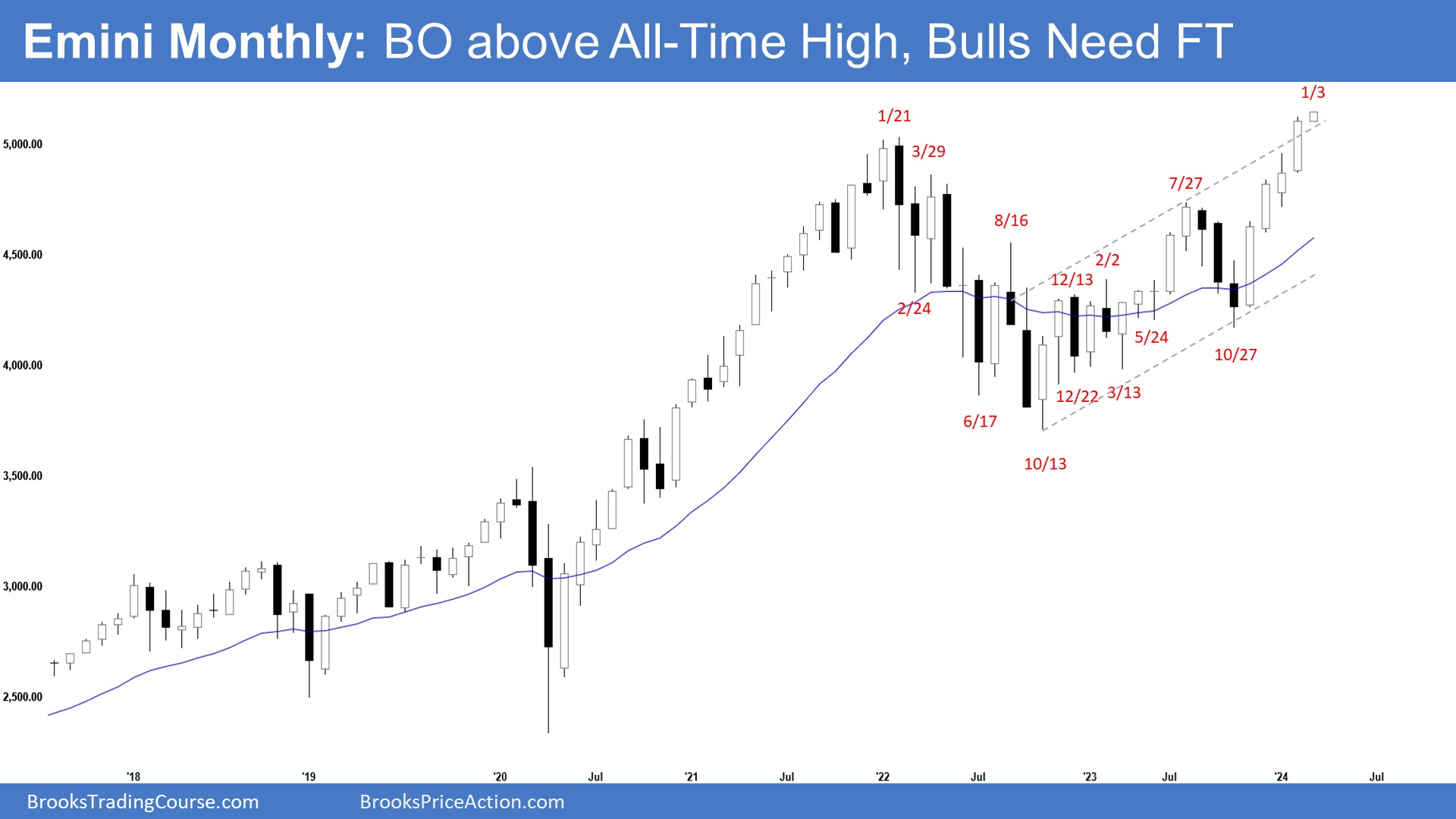

The monthly chart formed an S&P 500 Emini breakout above the prior all-time high. The bulls will need to create a follow-through bull bar in March to confirm the breakout even if it is just a bull doji. The bears will need a strong sell signal bar or a micro double top before traders will be willing to sell more aggressively.

S&P 500 Emini Futures Emini Monthly Chart

Emini Monthly Chart

- The February monthly Emini candlestick was another consecutive big bull bar closing above the all-time high.

- Last month, we said that the odds slightly favor February to trade at least a little higher. However, the rally has also lasted a long time and is slightly climactic and a minor pullback can begin within a few months before the market resumes higher.

- The bulls want a breakout above the all-time high and got it in February.

- They will need to create a follow-through bull bar in March to confirm the breakout even if it is just a bull doji.

- If the market trades lower, they want it to be sideways with overlapping candlesticks.

- The bears see the current rally as a retest of the January 2022 all-time high and want a reversal from a higher high major trend reversal.

- They also see a large wedge pattern (Dec 2, July 27, and Mar 1).

- Because of the strong rally in the last 4 months, they will need a strong sell signal bar or a micro double top before traders would be willing to sell more aggressively. So far, there is no strong signal bar yet.

- Since February closed near its high, it is a buy signal bar for March.

- For now, odds slightly favor March to trade at least a little higher.

- The market remains Always In Long and the bull trend remains intact (higher highs, higher lows).

- The rally has lasted a long time and is slightly climactic. Traders are looking for signs of a pullback. There are none yet.

- Until the bears can create a strong sell signal bar, odds continue to favor the market to trade sideways to up.

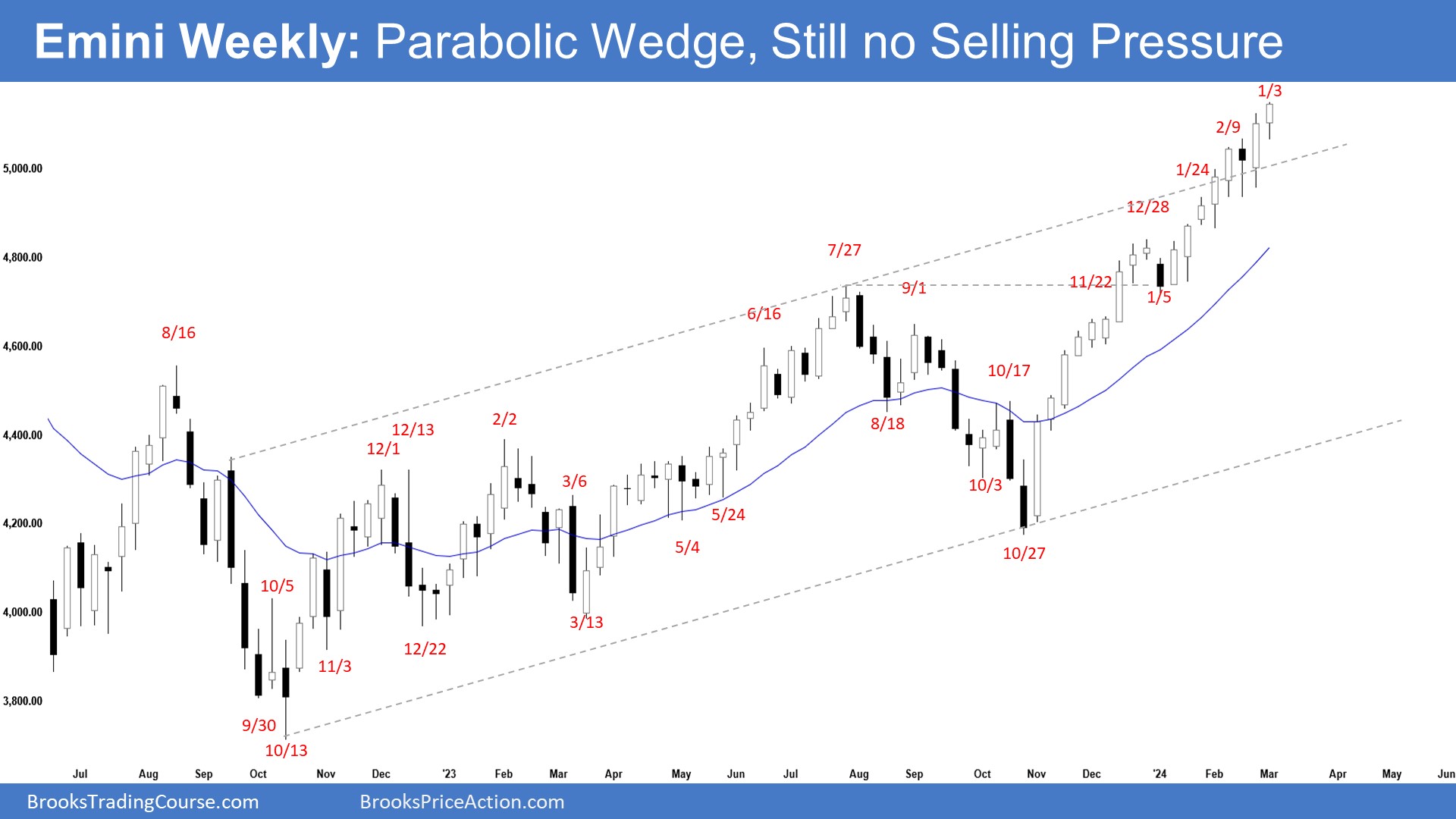

S&P 500 Emini Weekly Chart

S&P 500 Emini Weekly Chart

- This week’s Emini candlestick was a bull bar closing near its high.

- Last week, we said that while the market continues to be Always In Long, the rally has lasted a long time and is slightly climactic. Traders will see if we start to get more selling pressure or will the bulls continue to create follow-through buying.

- This week traded sideways to down earlier in the week but reversed higher by the end of the week. The bears are still not able to create any selling pressure.

- The bulls have a tight bull channel. That means strong bulls.

- They want a strong breakout into a new all-time high territory, hoping that it will lead to many months of sideways to up trading.

- They will need to continue to create sustained follow-through buying above the prior all-time high.

- We may also see some profit-taking activity once the market starts to stall.

- If a pullback begins, the bulls want it to be sideways and shallow, filled with bull bars, doji(s) and overlapping candlesticks.

- The bears hope that the strong rally is simply a buy-vacuum test of the prior all-time high.

- They want a reversal from a higher high major trend reversal and a large wedge pattern (Feb 2, July 27, and Mar 1). They want a failed breakout above the all-time high and the trend channel line.

- They also see a parabolic wedge in the third leg up since October (Nov 22, Dec 28, and Mar 1) and an embedded wedge (Jan 24, Feb 9, and Mar 1).

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of at least 5-to-10%. They want at least a test of the 20-week EMA.

- The problem with the bear’s case is that the rally is very strong. They would need to create a few strong bear bars to indicate that they are at least temporarily back in control. So far, they have not yet been able to do so.

- Since this week’s candlestick is a bull bar closing near its high, it is a buy signal bar for next week.

- The market continues to be Always In Long and odds slightly favor the market to trade at least a little higher.

- The rally has lasted a long time and is slightly climactic. Traders are looking for signs of a minor pullback but there are none still.

- The bears continue to fail creating any selling pressure.

- Until the bears can create strong bear bars, traders will not be willing to sell aggressively.

- Sometimes, a euphoric market (as it is now) can continue higher into a blow-off top (parabolic climax).

- Traders will see if the bulls continue to create more follow-through buying.