Russell 2000 Breakout Support Remains Intact; Nasdaq, S&P 500 Bull-Trap Risks Fade

US500

-0.29%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-1.90%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

-1.82%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

-0.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

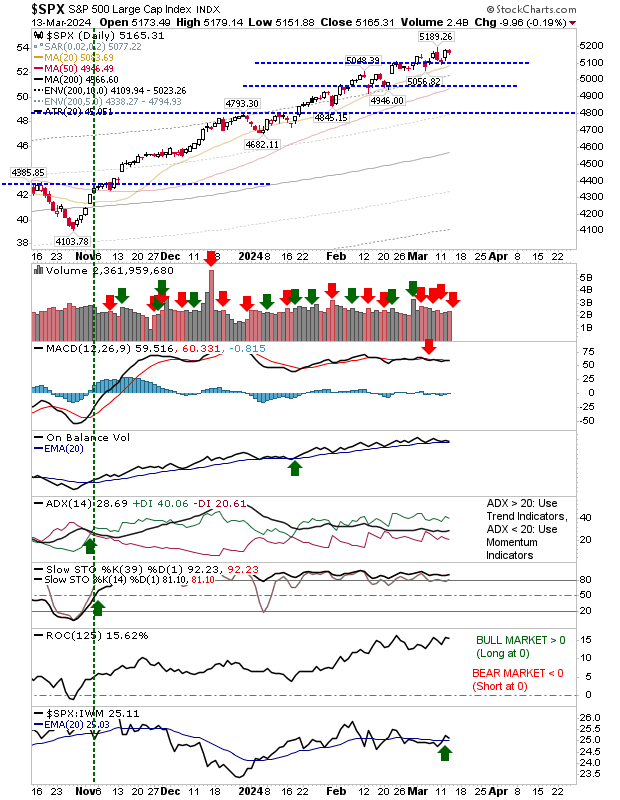

The earlier ‘bull trap’ risks look safely put to bed as yesterday’s losses just dipped into the day before yesterday’s gains.

The S&P 500 moved into a period of outperformance relative to the Russell 2000 (IWM), although it came with higher volume (distribution) selling.

The MACD is still on a ‘sell’ trigger, although it has flat-lined for most of 2024.

SPX-Daily Chart

SPX-Daily Chart

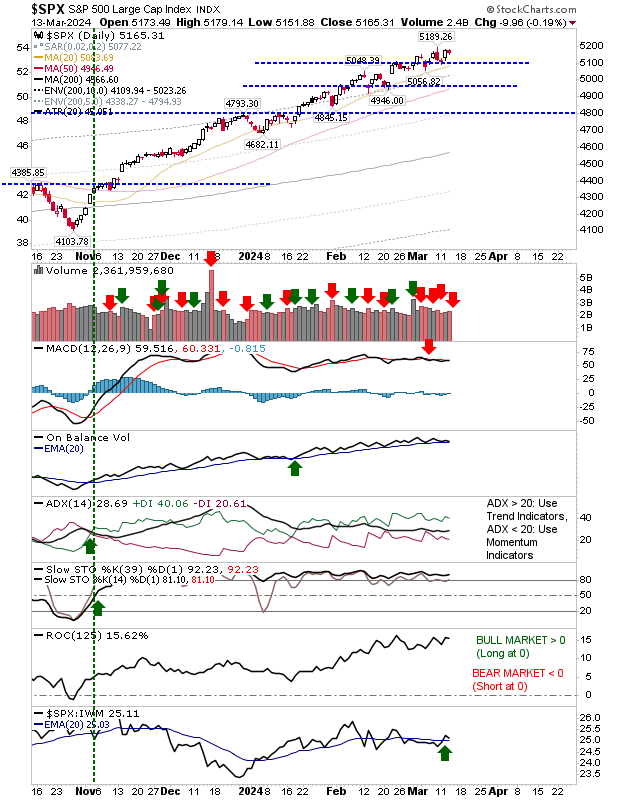

The Nasdaq is working through a more substantial ‘bearish engulfing pattern’, but without the higher volume distribution of the S&P 500.

It has ‘sell’ triggers in the MACD and On-Balance-Volume to work off, in addition to a relative underperformance to the S&P 500 (but not the Russell 2000).

SPX-Daily Chart

SPX-Daily Chart

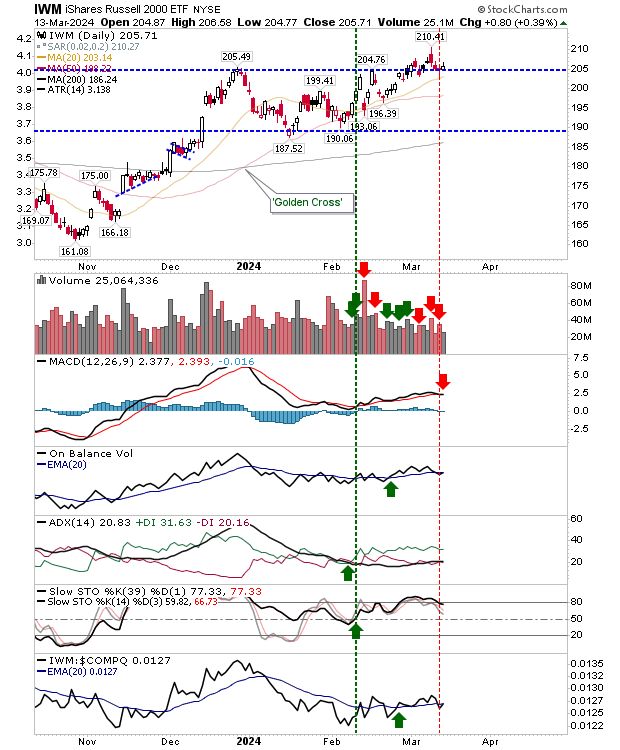

The Russell 2000 ($IWM) is perhaps the index most vulnerable to further selling given it has finished on breakout support.

The breakout remains intact, but further losses and a loss of the 20-day MA would signal something worse; a move back to $190 would seem to be the most likely outcome of a loss of breakout support.

IWM-Daily Chart

IWM-Daily Chart

The Russell 2000 ($IWM) is the index that typically leads bull and bear markets. At the moment, it’s still on the bull’s side, but if there is a loss of breakout support before the end of the week then play it more cautiously for the Nasdaq and S&P 500.