LNG developer Tellurian to explore sale among other options, CEO steps down

TELL

-11.42%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

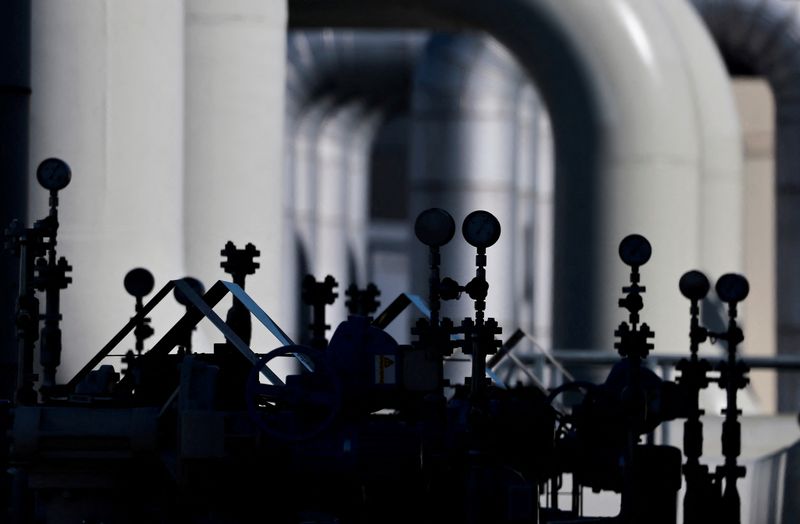

(Reuters) -Tellurian said on Monday it was looking at all options, including a potential sale, and that CEO Octavio Simoes had stepped down from his role, amid the liquefied natural gas developer’s efforts to keep its Driftwood export project alive.

The company’s shares fell nearly 8% to 88 cents in early trading. They lost 55% of their value in 2023 as the company has not been able to attract commercial support for Driftwood and is yet to give the financial green light for the project.

Tellurian (NYSE:TELL) earlier this year had hired Lazard (NYSE:LAZ) to explore a sale of its Haynesville upstream business in East Texas and Louisiana as part of efforts to raise capital for the Driftwood project.

Lazard will now also focus on alternative debt and equity financing, the sale of equity interests in Driftwood or Tellurian, a potential sale of the company, and assisting in securing commercial partners, Tellurian said on Monday.

Simoes, who resigned on March 15, has transitioned to an advisory role and will report to the company’s president. He will retire in June. The company had previously said it would not renew or extend his employment term beyond June 5.

Samik Mukherjee, executive vice president of Driftwood Assets, has been appointed as president of Tellurian Investments.

He will be in charge of development of all Tellurian’s assets, including upstream, Driftwood LNG and pipeline.

The change is the latest top level reshuffle at Tellurian after it ousted chairman and co-founder Charif Souki late last year.

The company said it could sell up to $366.1 million shares from time to time through distribution agency Virtu Americas.