GBP/USD bounces off 200-day SMA

GBP/USD

+0.23%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GBPUSD

GBPUSD

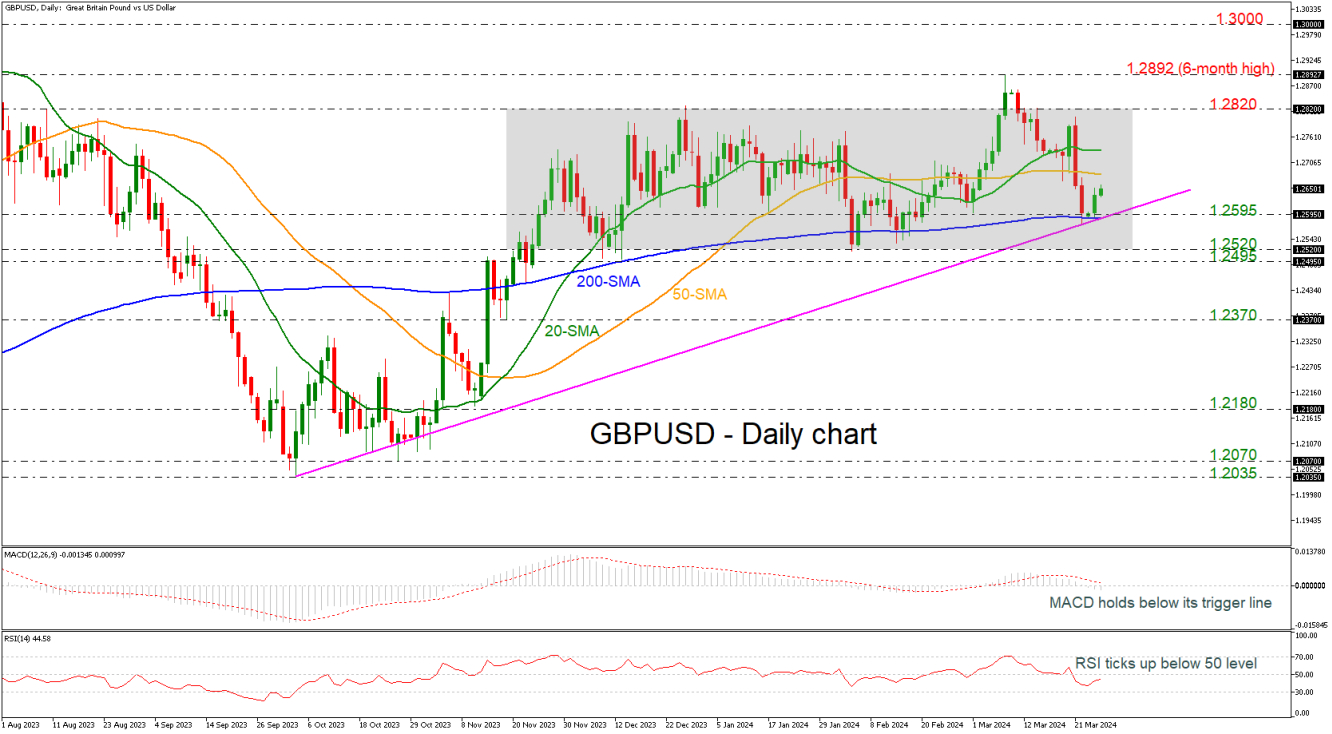

· GBP/USD finds support at uptrend line

· But short-term outlook remains neutral

· MACD and RSI are mixed

GBP/USD rebounded off the 200-day simple moving average (SMA), which coincides with the 1.2595 support level and the medium-term ascending trend line. The market has still been developing within a consolidation area since November 21, despite the break to the upside that it had on March 8, which seems to be a failed signal.

Technically, the MACD oscillator is moving beneath its trigger and zero lines; however, the RSI is pointing upwards in the bearish territory.

If the market continues to the upside, it could find immediate resistance at the 50-day SMA at 1.2680 ahead of the 20-day SMA at 1.2730. Surpassing these lines, the upper boundary of the channel may halt bullish actions at 1.2820.

On the flip side, a successful dive below the uptrend line and the 200-day SMA, then the market may switch to a bearish one, hitting the 1.2495-1.2520 support region. Even lower, the 1.2370 barricade could be the next level to look for.

In a nutshell, GBP/USD returns back to a neutral phase after the climb towards the six-month peak of 1.2892 and to endorse the bullish outlook again, traders need to wait for a climb beyond the aforementioned level.