Fed Meeting Looms: Powell to Tackle Slowing Growth Amid Persistent Inflation

EUR/USD

-0.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-0.72%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DX

+0.32%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2YT=X

-0.67%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

-

Following the ECB, all eyes are on the Fed’s upcoming interest rate decision, and the US central bank is anticipated to hold rates steady.

-

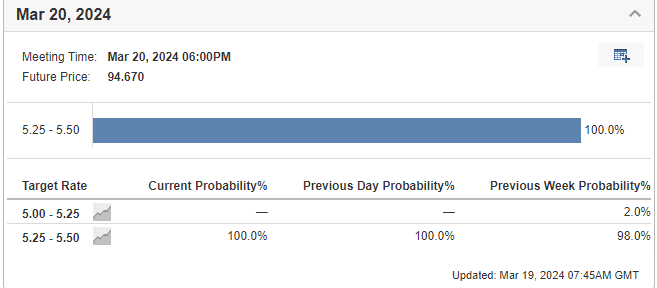

Our proprietary tool now indicates a near-certainty of the Fed refraining from rate hikes in tomorrow’s decision.

-

Powell’s forthcoming remarks on interest rates will be key for investors, shaping investment strategies going forward.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

After the ECB’s decision, the Fed is also expected to leave interest rates unchanged, barring any surprises.

The likelihood of the Fed halting rate hikes is now nearly certain in tomorrow’s decision, with our proprietary tool indicating a 100% probability (up from 98% the previous week).

Fed Rate Probability

Fed Rate Probability

Here’s What to Expect From Powell

- Interest Rates: The Federal Reserve is expected to maintain interest rates at the highest level in 23 years, ranging between 5.25% and 5.5%. This aims to control inflation, but investors hope for a swift rate cut. Inflation has retreated from its peak in 2022 but remains above the Fed’s 2% target.

- Dot Plot and Projections: Powell will present the dot plot during the press conference, illustrating interest rate projections until 2026.

- Balancing Decisions: Powell must balance a gradually slowing labor market with a robust consumption trend.

Investors and analysts will closely monitor Powell’s remarks to gauge the Fed’s future actions and their impact on global markets.

Monetary policy decisions and rate projections will significantly influence future trading strategies and economic outlooks.

Regarding asset classes and portfolios, here’s what different asset classes could indicate about what Powell might say:

- US United States 2-Year Yields: A rise suggests market impatience for a prolonged period of higher rates.

- EUR/USD: A more accommodative outlook and potential rate cuts could weaken the US dollar.

- Small Cap Stocks: A spike in the Russell 2000 may indicate expectations of a rate cut.

However, it’s important not to assume anything, as Fed rate cuts in 2024 are not guaranteed.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,485% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Subscribe Today!

Subscribe Today!

Remember the 10% discount on the annual Investingpro+ subscription with the code “proit2024.” Click on the green banner above, and when paying, enter the code.

Disclaimer: