Growth Surprises Could Nudge Up Bond Yields

US2YT=X

-0.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US3YT=X

-0.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

-0.42%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US30Y…

-0.39%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The US economy has surprised to the upside over the past few weeks but yields have not shown much reaction to this narrative. We see this as one of the reasons why US yields may test higher. Looking forward, US CPI numbers will take the spotlight and we expect these to be the key driver of global rates

Upside US Growth Surprises Should Nudge Up Yields

The US economy seemed to follow a textbook trajectory in which tighter monetary conditions were followed by a slowing economy and inflation back to target, but recent headlines suggest we might need to have a bit more patience. And the Fed and the European Central Bank are also not convinced yet that rate cuts are imminent. Just this Thursday, Barkin of the Fed said a downward turn of the economy would make a case for rate cuts, which does not translate into cuts in the current environment.

That links to the next point – growth in the US seems stubbornly robust, supporting the view of some tactical upside to US yields. Last week’s non-farm payroll numbers were a reminder that the economy is holding up surprisingly well despite the monetary tightening of the past year.

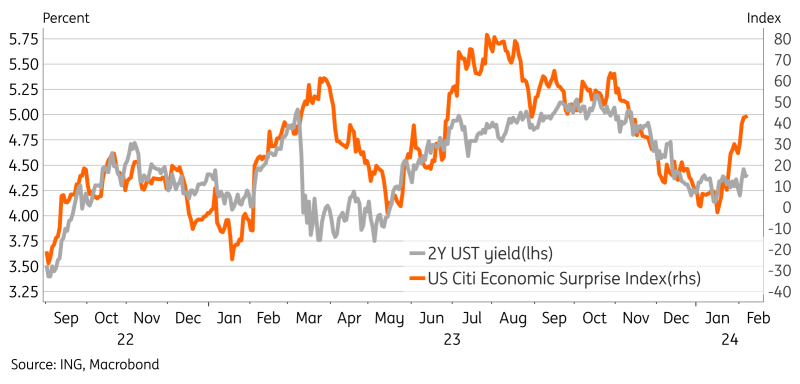

The payroll numbers were not a one-off exception as evidenced by the Citi Economic Surprise Index, which aggregates data surprises from a range of indicators, showing a steep rise in recent weeks. US yields, however, do not seem to pay much attention to a growth revival narrative.

The figure below shows that 2-year UST yields, the point on the curve most sensitive to upcoming rate cuts, showed little to no response to the outbreak of the Citi index so far. One explanation is markets’ focus on falling inflation instead of growth, but even then we would argue that stronger growth dynamics should have a delaying effect on the timing of a first rate cut (as Barkin hinted at).

2-Year UST Yields Have Ignored Recent Growth Surprises

2Y UST Yield Chart

2Y UST Yield Chart

US CPI Numbers Set to Lead Global Rates

On Friday we have the US CPI seasonal adjustment revisions, which won’t affect the overall 2023 inflation number but may change the inferred downward momentum of the past few months. Our economist does not foresee much impact, but due to the focus on recent month-on-month CPI readings, markets may be more sensitive to such technical details than usual. Seeing that markets are keen to test higher long-end yields, markets may find an excuse for a tick upwards on the back of the revision outcomes.

Of course, next week’s US CPI data will be the real number to watch and is expected to come in at 2.9%. We expect that the downward inflation narrative will continue. In the UK we also have a CPI reading and in the eurozone, we will see preliminary fourth quarter 2023 GDP data. For the eurozone, the growth story is clearly a lot weaker than in the US, but we see some signs that the downturn is bottoming out. Having said that, the recent moves in global rates seem to have come from the US and we expect that euro rates will stay in the passenger’s seat next week.

Friday’s Key Data and Events

Overall a light day of events. The US CPI revisions is probably the most exciting thing to look forward to on Friday. In terms of speakers, we have the ECB’s Nagel and Cipollone and from the Fed we have Logan.

A strong 30-year US Treasury auction last night after the 3-year and 10-year sales already met good demand caps of this week’s main supply events.

Disclaimer: