Australia jobs surge in Feb, unemployment shrinks

AXJO

+0.54%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AUD/USD

+0.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

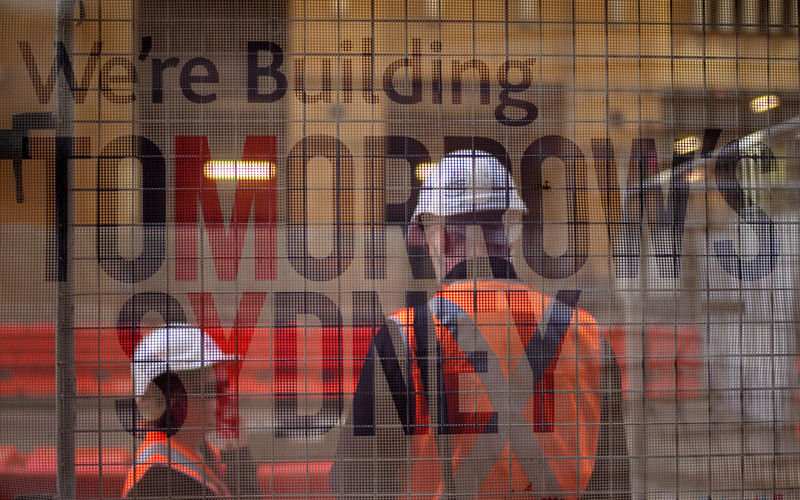

Investing.com– Australia’s labor force grew substantially more than expected in February, putting unemployment back at a six-month low as a swathe of people returned to work from an extended year-end holiday.

The total number of employed people grew by 116,500 in February, data from the Australian Bureau of Statistics showed on Thursday. The reading was much higher than expectations for a rise of 39,700 people, and accelerated sharply from the 500 seen in the past month.

The jump in employment put Australia’s unemployment rate at 3.7% in Feb, after it had unexpectedly surged to a two-year high of 4.1% in January.

Australia’s participation rate– ie the percentage of the working-age population that is in the workforce- contracted slightly to 66.7%.

But the outsized increase in employment signaled that Australia’s labor market was still running strong despite pressure from a cooling economy and high interest rates.

Persistent strength in the labor market gives the Reserve Bank of Australia more headroom to keep interest rates higher for longer. While the bank reiterated this notion at a meeting earlier this week, it struck a less hawkish tone than markets were expecting.