Bonds Like Fed FOMC Days, but the Joy Fades Quickly

TLT

+0.96%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-0.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

QQQ

+0.11%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

-1.38%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLE

-0.22%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SMH

+0.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Rather than trying to outsmart how the Fed’s policy meetings will affect the markets in the future, why not just let the markets tell you how they feel?

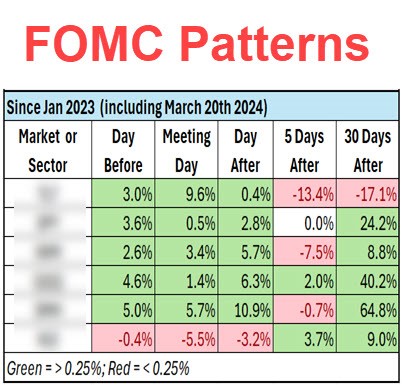

FOMC Patterns

FOMC Patterns

The market’s message isn’t always obvious, and history isn’t a perfect guide, but sometimes its patterns are very insightful.

Occasionally, simple patterns in the data might even cause you to discover a perspective that you thought was true, but “just ain’t so” (as Mark Twain once warned).

As Mish mentioned in a recent Daily and as I covered in last week’s Market Outlook, the long bond (TLT) is at a potentially big inflection point.

According to that previous article, if the TLT were to move over 3% in either direction over a 4-8 week period, it could have a real impact on stock prices (see last week’s Market Outlook for details).

Since the TLT is in such an important position, I did some research to see if FOMC meetings have had a noticeable (and thus predictable) impact on market trends.

Here are some interesting insights.

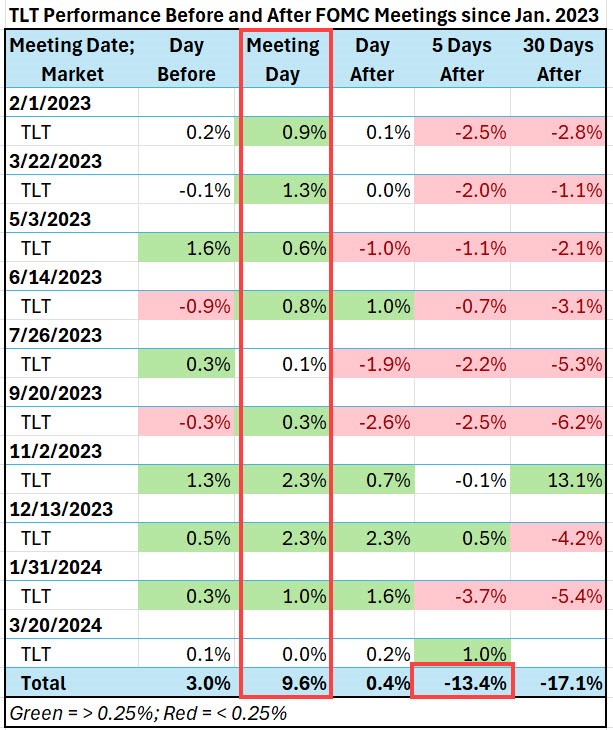

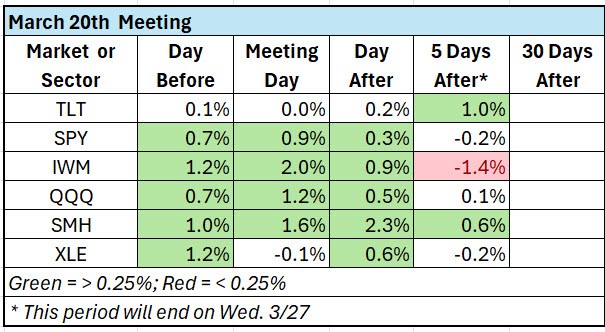

Below, you’ll find a table that shows how the TLT performed on the day prior to the Fed’s FOMC announcement, then on the day of the announcement, the following day, and finally, the following 5 and 30 days.

Note that the green and red shading indicates a move of at least 0.25% up or down, respectively.

TLT-Performance

TLT-Performance

However, Fed Chair Powel’s bullish influence fades the following day as demonstrated by the fact that the day’s performance has mixed returns.

By the 5th day after the meeting, the TLT’s have tended to be trading lower than their bullish FOMC day close.

If you look at the last row in the table, labeled “Total,” you’ll see the sum of each period’s performance, which demonstrates that since the start of 2023 TLT has gained 9.6% on Fed announcement days and lost 13.4% in the 5-day period following the announcement.

In fact, the 5 and 30-day periods following the meeting have been bearish.

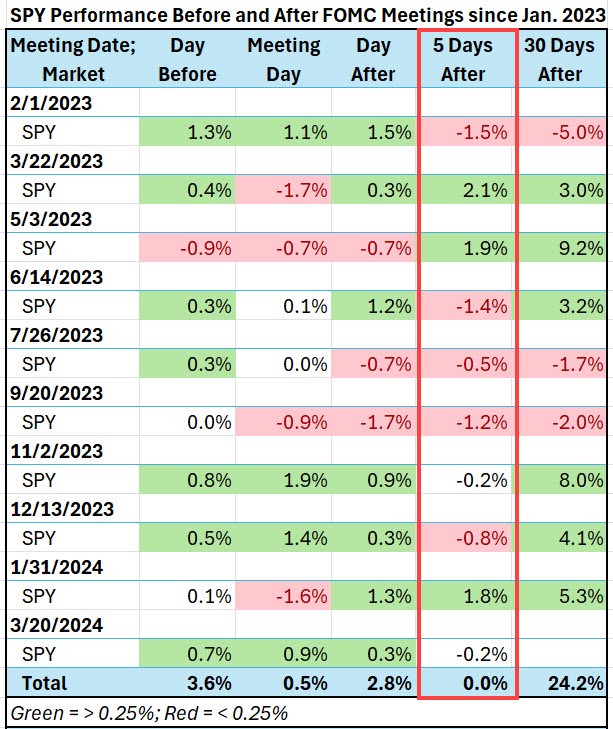

Below you’ll find the same table for the S&P 500 (SPY).

SPY-Performance

SPY-Performance

This isn’t surprising considering the weakness in TLT during this period and the focus on interest rates around the FOMC meeting.

However, that same positive correlation between stocks and interest rates has not been as strong over the longer 30-day period. After the 5-day FOMC weakness, stocks have marched higher regardless of TLT’s weakness.

Other factors, such as earnings expectations and AI enthusiasm, could easily explain why stocks would buck a bearish trend in rates.

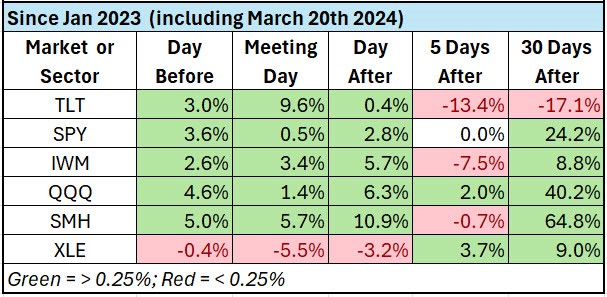

In the tables below, you’ll see the summary data for additional indexes and sectors.

Additional Indexes And Sectors Performance

Additional Indexes And Sectors Performance

One pattern that stands out in the summary table above is that SMH has shown some weakness in the 5 days following Fed meetings, but it’s also been the best performer in every other time frame other than one – Meeting Day, which is clearly won by TLT.

What you can’t see in the data I’ve shared here is that when SMH has been strong, SPY and QQQ have overcome bearish sentiment from weakness in TLT.

In summary, if SMH and TLT are going in the same direction, don’t fight it.

Finally, you’ll notice that I’ve also included XLE, the energy ETF, in the table above and below. As you can see from the table above, XLE has had a bearish trend around the meeting dates over the last year.

However, as you’ll see in the table below, which shows the performance of all of the same indexes and sector ETFs for last week’s Fed meeting, XLE had a relatively bullish reaction to the last meeting so far. Performance after Fed Meeting

Performance after Fed Meeting

Is the XLE performance an indication that its recent strength is a trend that will continue?

We’ll certainly be keeping an eye on it. Considering all the perspectives on the patterns discussed up to this point, there are some noteworthy patterns from last week’s Fed meeting.

- The TLT’s movement was the most muted (least volatile) of any meeting in the last year.

- Energy was more bullish than it has been over the last year.

- SPY, QQQ, and IWM didn’t do anything unusual relative to their trading patterns around FOMC days over the last year.

Be aware…

The beginning of the upcoming week is part of the weak 5-day post-FOMC meeting period. It could present some good trading opportunities.

Be cautious if TLT and SMH slide substantially and in tandem.

ETF Summary

S&P 500 (SPY) 510 pivotal

Russell 2000 (IWM) 202 if holds good sign

Dow (DIA) 385 support 400 resistance

Nasdaq (QQQ) 428 the 50-DMA support

Regional banks (KRE) 45-50 range

Semiconductors (SMH) 214 support 224 resistance to clear

Transportation (IYT) 68 area support

Biotechnology (IBB) 140-142 resistance 135 support

Retail (XRT) 73 support 77 resistance

iShares iBoxx Hi Yd Cor Bond ETF (HYG) 77 big number to hold. Over 78 risk ON