Fed Stance Explained? US Growth Could Slow Further as Job Market Rebalances

The US economy remains on track to post a moderate growth rate in the upcoming first-quarter GDP report, but the expansion shows signs of slowing.

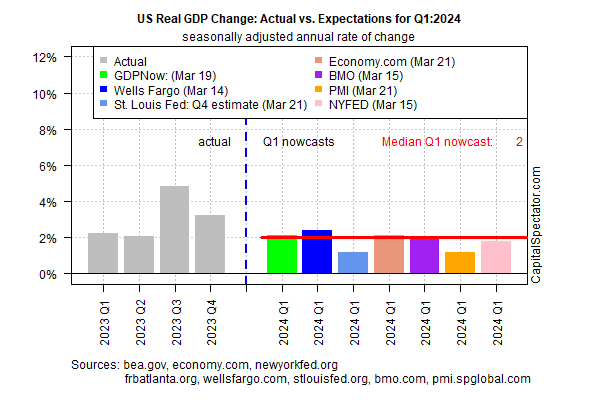

Output for the January-through-March period is estimated at a 2.0% increase (seasonally adjusted real annual rate), based on the median for a set of nowcasts compiled by CapitalSpectator.com.

If correct, the moderate increase will mark another downshift in growth from Q4’s strong 3.2% advance.

US Real GDP Change

US Real GDP Change

A 2.0% rise in GDP is comfortably above the level that would ring alarm bells for recession risk, but today’s revised median nowcast marks another downshift for the current quarter.

The previous Q1 median estimate: 2.1%, posted on Mar. 15. At the end of February, the median nowcast was higher still at 2.3%.

Although the recent downside revisions have been slight, the directional bias suggests that economic activity is losing momentum, albeit on the margins.

The key question is whether the softer trend will stabilize at or near current levels or deteriorate further in the months ahead.

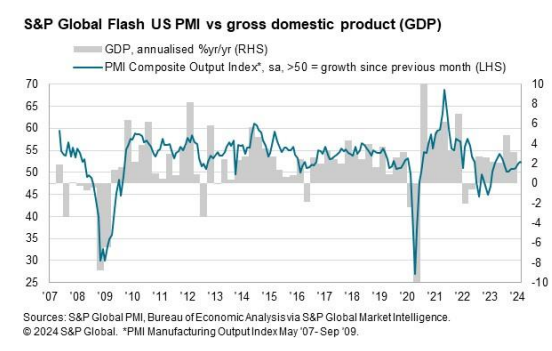

A similar profile of slightly softer growth was highlighted in yesterday’s PMI survey data. The US PMI Composite Output Index (a GDP proxy) eased to 52.2 in March, down slightly from February’s 52.5.

Both readings are modestly above the neutral 50 mark that separates growth from contraction. The latest update still signals “a solid monthly improvement in business activity at US companies,” advises S&P Global, which publishes the PMI data. US Flash PMI vs GDP

US Flash PMI vs GDP

Perhaps the Federal Reserve’s inclination to cut rates later this year, despite recent sticky inflation news, is a recognition that economic momentum is easing and that the current policy rate is too high to keep output humming.

Despite the softer trend in US economic activity, the odds remain low that stall speed or worse is a near-term risk. That’s partly due to the ongoing resilience of the US labor market, a key economic factor.

Yesterday’s update on weekly jobless claims, for instance, highlights the ongoing positive trend as new filings for unemployment benefits dipped, printing near a multi-decade low.

“The labor market is gradually rebalancing, but the adjustment appears to be coming from less hiring rather than a surge in firings,” says Rubeela Farooqi, chief US economist at High Frequency Economics.

“We expect job growth to slow somewhat but the unemployment rate to remain low this year.”