CPI Preview: Shelter Costs Hold the Key to Rate-Cut Clues

XAU/USD

+0.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XAG/USD

-0.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold

-0.08%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Silver

-0.28%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

-

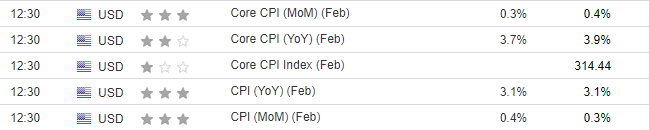

Today’s spotlight is on the crucial US CPI report, with estimates suggesting potential declines in both the monthly and annual core CPI.

-

Market expectations project a decrease in the annual Core CPI from 3.9% to 3.7%, while the overall CPI data is anticipated to remain unchanged at 3.1%.

-

The shelter component’s downward trend holds key implications for easing inflation going ahead and will provide hints about potential rate cuts.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Today marks the release of the week’s most crucial data, the US CPI report.

According to Investing.com’s economic calendar, estimates indicate that the core CPI component might experience both monthly and annual declines.

At the same time, the overall CPI data is expected to remain unchanged.

US CPI Data

US CPI Data

Market expectations for the data:

- Annual Core CPI: Expected to decrease from 3.9% to 3.7%

- Annual CPI: Expected to remain unchanged at 3.1%

- Monthly Core CPI: Anticipated to decrease slightly from 0.4% to 0.3%

- Monthly CPI: Expected to increase slightly from 0.3% to 0.4%

If the data falls, the following asset classes may see potential revaluations based on recent analysis:

- Small Cap

- Bonds

- Precious Metals (Gold/Silver Futures)

It won’t be surprising if treasury yields drop in case of lower-than-expected CPI (and vice versa).

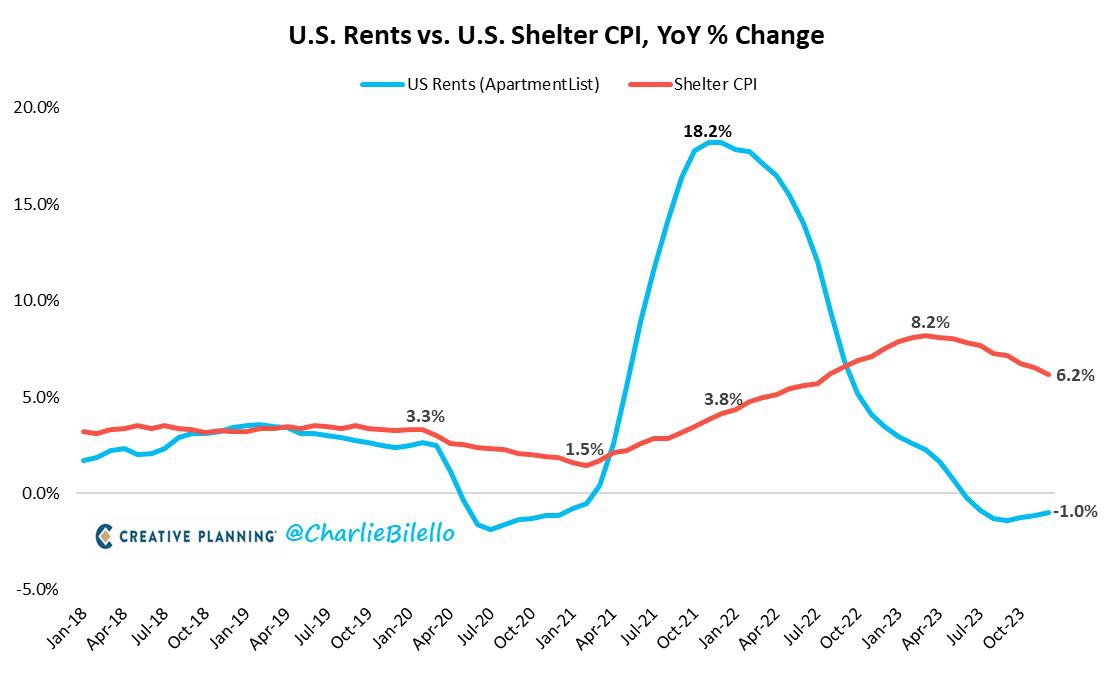

The housing component, specifically Shelter, remains uncertain. It’s a lagging element and as illustrated below, it has been on a downward trend for some time:

Fonte: Charlie Bilello

Fonte: Charlie Bilello

Conclusion

The Shelter component holds a significant 33% weight in the overall Consumer Price Index (CPI). Therefore, the downward trend must persist if we want to observe a consistent decrease in inflation.

If the data turns out to be lower than expected, there could be a positive impact. The Federal Reserve might reconsider its initial plan for an interest rate cut. This, in turn, could lead to market rallies.

***

Subscribe Today!

Subscribe Today!

Disclaimer: