Gold: Bears Likely to Command Second Half of March

XAU/USD

+0.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold

-0.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Since I explained the overbought territory could result in a selling spree in my last analysis on March 11, 2024, gold futures continue to slide amid volatile moves.

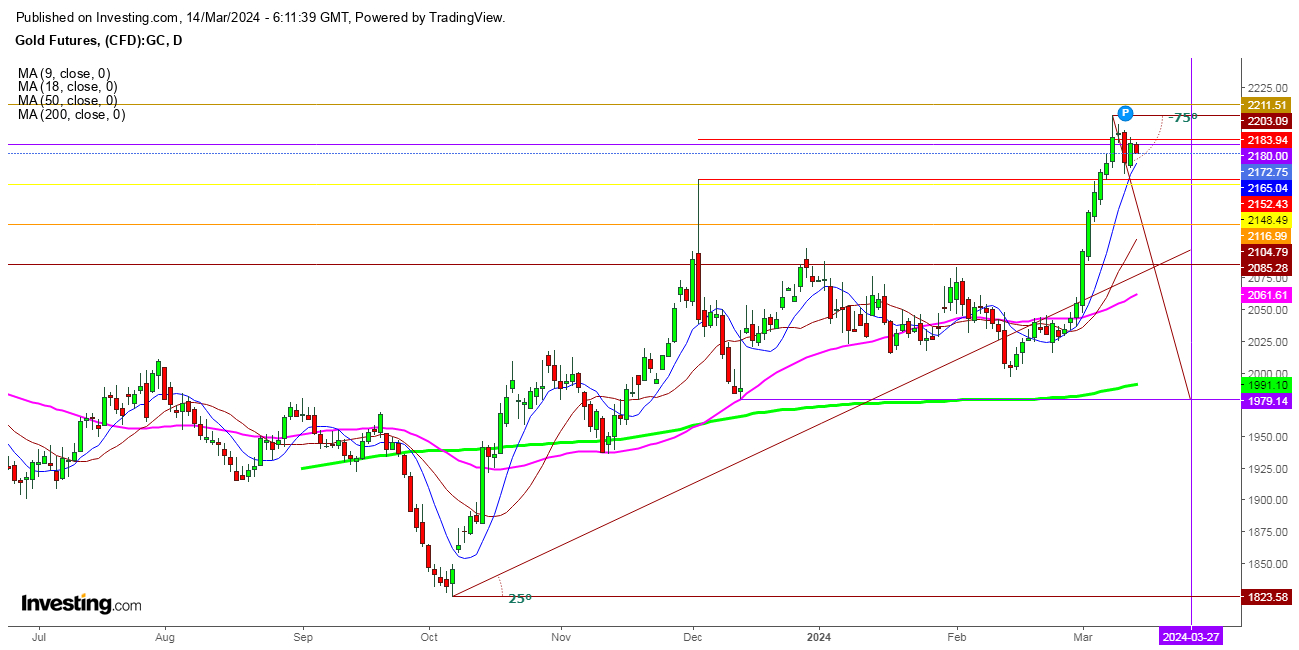

As I pointed out the formation of a bearish dozy that needed a confirmation candle last Tuesday was a sufficient indicator for the traders, and the yellow metal exactly behaved as I predicted by hitting a low at $2157 after testing the day’s high at $2192. Gold Futures-Daily Chart

Gold Futures-Daily Chart

Undoubtedly, the gold futures started the next trading session in anticipation of some reversal after a sharp fall and remained in the green despite the immediate resistance at $2184 was there on Wednesday.

On Thursday, gold futures started with a little gap down at $2179.80 and trading at $2172.80, indicating bearish pressure at current levels, as the gold bears await here for some more cues from upcoming producer price index and retail sales.

CPI data showed U.S. inflation grew slightly more than expected in February, remaining well above the Fed’s 2% annual target.

The reading presents the Fed with less impetus to trim interest rates early, although traders still maintained bets on a 70% chance for a 25 basis point cut in June.

Undoubtedly, few more signs of resilience in the economy give the Fed more headroom to keep interest rates higher for longer.

Such a scenario bodes poorly for gold, with strength in the U.S. economy also likely to sap the yellow metal of haven demand. But the yellow metal was still sitting on good gains so far in 2024.

Finally, I conclude a breakdown in gold futures in today’s session below the immediate support at 9 DMA is at $2165, and a weekly closing below the second support at 18 DMA is at $2104.80, which could keep the slide continuing during the upcoming week.

On the flip side, gold futures could reach $2184, which could provide an opportunity to take a short position in the gold futures with a stop loss at $2193, and the target could be at $2173 till this week’s closing as the gold futures have completed the formation of a bearish pattern during this week.

Disclaimer:

Disclaimer: