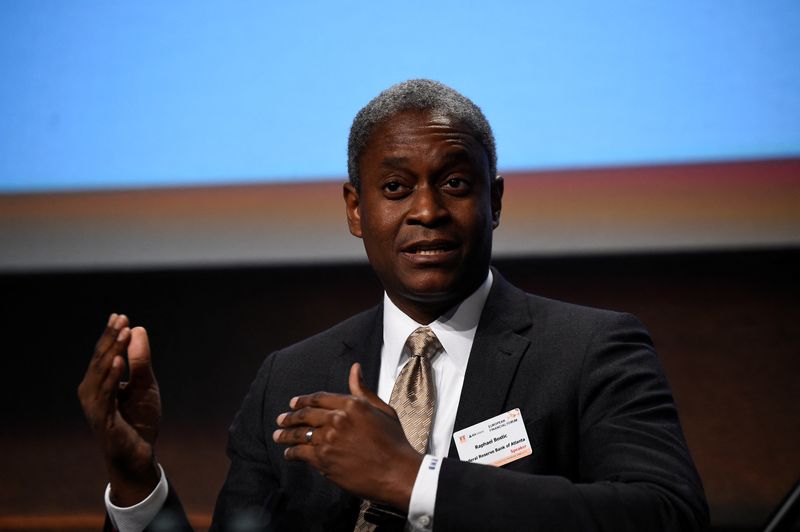

Sooner rate cuts may fuel economic wave, undo inflation progress: Fed’s Bostic

Investing.com — Atlanta Fed President Raphael Bostic said Monday that more progress would be needed to back interest rate cuts flagging the risk that expectations for sooner rate cuts could spark a wave of economic activity, undoing the central bank’s recent progress on curbing inflation

“I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2 percent over time. Only when I gain that confidence will I feel the time is right to begin lowering the federal funds rate to dial back restrictive monetary policy,” Bostic said.

The Atlanta Fed chief, who still expects the central bank to cut rates twice this year, also flagged the threat of “pent-up exuberance” as a a new upside risk that would have to be monitored in the coming months at time as the first hint of a rate cut could unleash a wave of economic activity, stoking fresh inflation pressures.

“If that scenario were to unfold on a large scale, it holds the potential to unleash a burst of new demand that could reverse the progress toward rebalancing supply and demand. That would create upward pressure on prices, he said.

The remarks come as U.S. economic activity has surprised to the upside even as evidence suggests that past tightening cycles had led to about a “half-percentage-point decline in real gross domestic product over two to two-and-a-half years—a recession, basically,” Bostic added.

Real GDP grew at a 3.3% annual pace in the fourth quarter of 2023, and at a 3.1% rate for all of 2023, Bostic says. This was not only more robust performance than private sector forecasts anticipated but also robust than what the Atlanta Fed expected.