S&P 500 E-Mini: Inside Bar Is Sign of a Trading Range Forming

ESM24

-0.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

S&P Emini Pre-Open Market Analysis

- The S&P Emini formed an inside bar yesterday, which is disappointing for the Bulls. This is a sign that the market is forming a trading range.

- The bulls are hopeful that yesterday is a pullback that will lead to a second leg-up follow-through Tuesday’s bull trend bar.

- Bears are continuing to close gaps above new highs. This increases the odds that the daily chart is evolving into a trading range and will go sideways soon.

- The bears ultimately need to get below the moving average in order to demonstrate that they are in control.

- Even if they get below the moving average, the odds favor a trading range, not a bear trend.

What to Expect Today

- Emini is up 6 points in the overnight Globex session.

- The Globex market rallied during the early morning hours and recently sold off back to the midpoint of yesterday’s range.

Yesterday’s Emini Setups

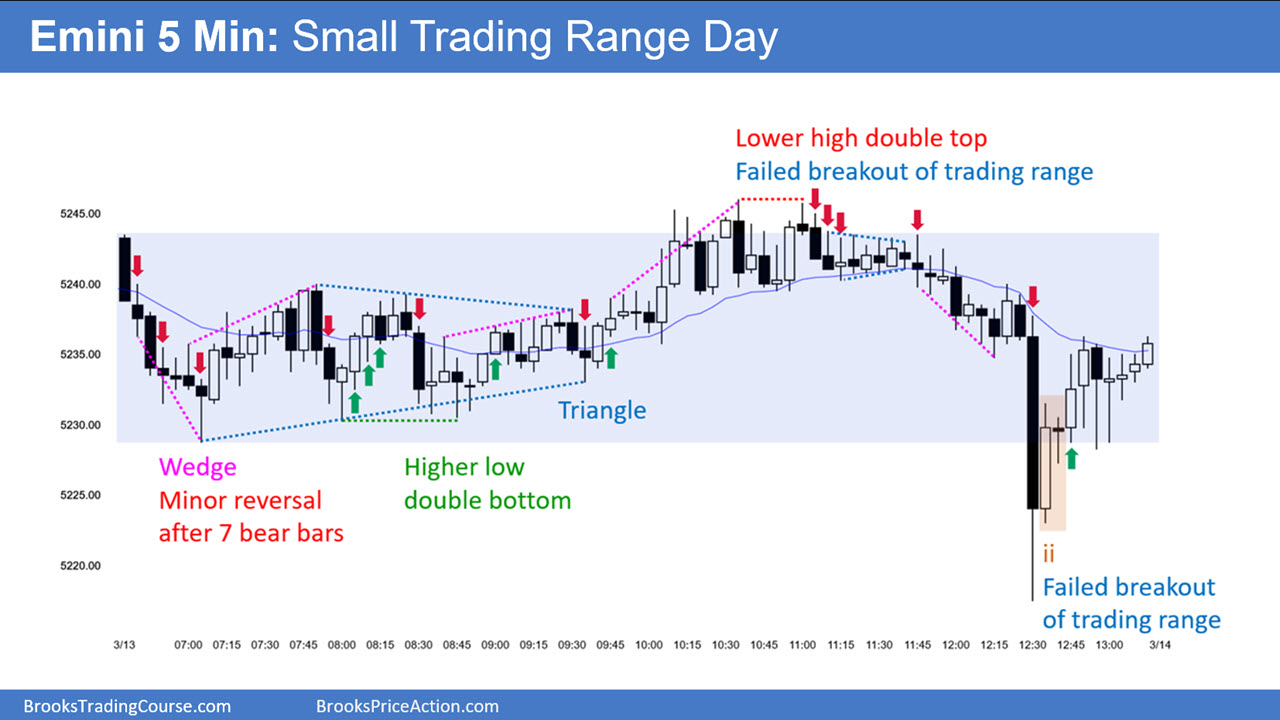

Emini 5-Minute Chart

Emini 5-Minute Chart

Here are reasonable stop-entry setups from yesterday. I show each buy entry bar with a green arrow and each sell entry bar with a red arrow. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a near 4-year library of more detailed explanations of swing trade setups (see Online Course/BTC Daily Setups). Encyclopedia members get current daily charts added to the Encyclopedia.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.