Taiwan Semiconductor: Japan Bet, AI Demand to Keep Countering Geopolitical Risks

TSM

+3.61%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AAPL

-0.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

+2.29%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

INTC

+1.90%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

005930

-1.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Taiwan Semiconductor emerged as a dominant force in the global chip industry in 2023.

- As a key supplier to tech giants Nvidia and Apple, TSM stands to gain from the soaring profits of its clients amid escalating chip demand.

- TSM’s exceptional 2023 performance has propelled its stock higher, but the question remains: Can the stock continue to post solid gains?

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

In 2023, Taiwan Semiconductor Manufacturing (NYSE:TSM) took the lead in the global chip industry, surpassing competitors like Samsung (KS:005930) and Intel (NASDAQ:INTC) in terms of revenue from chips.

The Taiwanese company’s key clients include tech giants Nvidia (NASDAQ:NVDA) and Apple (NASDAQ:AAPL). As these tech titans rake in profits amid the ever-increasing chip demand, Taiwan Semiconductor stands to benefit from it.

But TSM isn’t stopping there. In February, it launched its first factory in Japan. The once top-tier tech country is investing $5 billion in semiconductor production and urging TSMC to open a second plant.

The total investment alongside the second plant is set to surpass $20 billion, as per the Taiwanese company.

Taiwan Semiconductor at the Center of the US-China Chip War

TSM stands at the forefront of the chip war between the United States and China. Its success is not only attributed to its outstanding performance but is also influenced by the pivotal geopolitical role it plays in the global economic competition between these two nations.

Taiwan, being the epicenter of technology, holds a significant position. As per TrendForce, a research firm in Taipei, the island contributes to 60% of the global microchip production, surpassing South Korea, home to Samsung, which holds around 20% market share.

In the exceptional year of 2023, TSMC outshone its competitors. The company achieved a remarkable revenue of $69.3 billion throughout the year, surpassing Intel, which reached $54.23 billion, and Samsung, with a semiconductor revenue of $50.99 billion.

This outstanding performance has also translated into significant stock market success, with the TSM stock gaining over 50% in the past year. As of March 6, its market capitalization is close to $600 billion.  TSM Price History

TSM Price History

Can the Stock Continue to Soar?

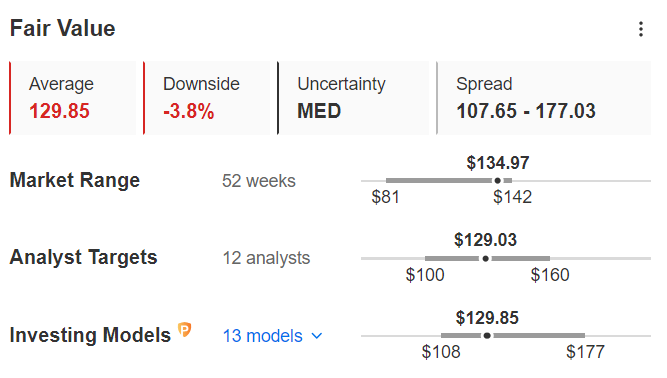

According to analysts and valuation models, TSM stock is fairly valued at current levels.

TSM Fair Value

TSM Fair Value

InvestingPro’s Fair Value, which summarizes 13 recognized financial models tailored to Tsmc’s specific characteristics, stands at $129.85, down 3.8% from the $134.97 recorded at the close on March 5.

Similarly, the 12 analysts surveyed by InvestingPro are also bearish on the stock and estimate a target price of $129.03 per share.

It’s crucial to highlight the wide range of predictions, with a bullish scenario reaching as high as $160 per share.

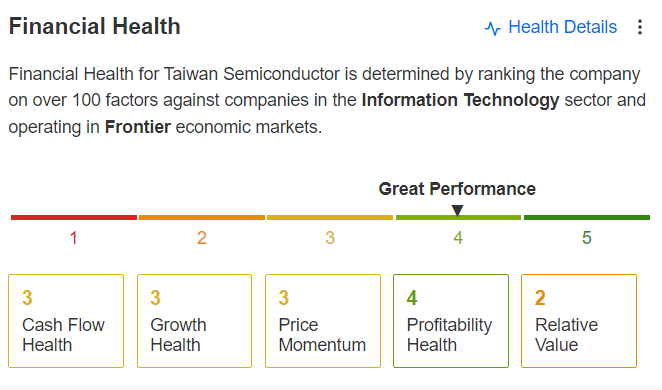

In addition, we should consider other factors, such as the company’s robust financial health, marked by a solid score of 4 out of 5.

src=

src=

What Does ProTips Tell Us About TSM?

Taking advantage of InvestingPro’s ProTips, one can see that TSM is set to tear up competition once again next year, according to analysts.

TSM Net Income Forecast

TSM Net Income Forecast

Taiwan Semiconductor Poised for Growth

TSM is confident about its future growth. The company’s 2024 outlook targets a minimum revenue increase of 20%. For the first quarter, TSM revised its revenue forecast to $18.8 billion, up from the previous estimate of $18.2 billion.

This growth is crucial for the Taiwanese industry after a year of overall decline. Despite industry challenges, TSMC has maintained its market dominance. Additionally, TSMC will commence construction of its first facility in Germany by year-end, and a $40 billion project in Arizona is slated for 2025 to meet U.S. demand.

Conclusion

In summary, TSMC holds ambitious plans and a strong growth foundation. However, will this be sufficient to drive the stock higher, following in the footsteps of its client Nvidia?

Currently, fair value analysts don’t foresee a significant surge in the stock. Yet, the dynamics can change swiftly. More insights may emerge on April 18 when TSM discloses its first-quarter 2024 earnings.

***

As readers of our articles, you can take advantage of our stock strategy and fundamental analysis platform InvestingPro at a reduced price, with a discount on the annual plan.

Subscribe to InvestingPro now to optimize your investment strategy and benefit from a special discount!

Click on the link, and the page will automatically calculate and apply the additional discount.

If the page doesn’t load, enter the code PRO124 to activate the offer.

Don’t miss out on this opportunity!

Subscribe Today!

Subscribe Today!

Disclaimer: This