USD/CHF Bulls Charge Ahead After SNB Cut: Breakout Above Key Resistance Likely

USD/CHF

+0.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DX

-0.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Swiss Central Bank surprised markets by cutting interest rates last week.

- Meanwhile, the Fed did not indicate when it may start cutting rates.

- Amid, these moves by the central banks, the USD/CHF pair is attempting to break above a key resistance.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Last week, Central Banks, including the Bank of Japan, Federal Reserve, Bank of England, and Swiss National Bank held meetings.

The Swiss National Bank’s decision was the most surprising, as it opted for a modest 25bp cut despite the market expectation to leave interest rates unchanged.

This led to the weakening of the Swiss currency against major currencies, including the US dollar, reflected in the USD/CHF currency pair.

Despite the initial dovish reaction after the Federal Reserve meeting, the US dollar showed strength by the end of the week, further supporting demand for the USD/CHF pair.

Currently, it seems likely that the uptrend will continue, although there are technical hurdles to overcome.

SNB President’s Departure: How Will It Impact Rates?

In March, Thomas Jordan, the current President of the Swiss National Bank, announced his resignation from the position he has held since 2012.

His successor will be inclined to implement interest rate cuts, and the recent 25 bps cut could just be the beginning.

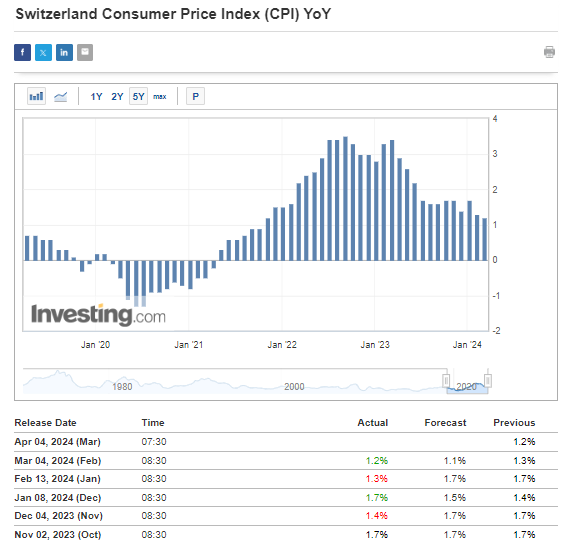

This unexpected move weakened the Swiss franc. The decision was driven by the stabilization of inflation within the target range and optimistic forecasts for the coming years.

SNB CPI

SNB CPI

The bank’s management announced the possibility of intervening in the foreign exchange market, a move not new for the SNB.

Future decisions are likely to hinge on evolving inflation dynamics. Given a decade of experience with zero and negative interest rates, it’s highly probable that the USD/CHF trend will continue.

Fed’s June Rate Cut Still in the Cards

The US dollar index, which measures the currency’s strength against a fixed basket of others, continues to rise.

Taking a broader view, there’s significant potential for the demand side to push the movement further northward, with the maximum range around the 107 points mark.

US Dollar Index Daily Chart

US Dollar Index Daily Chart

Buyers are eyeing the 105-point mark as their main target. Breaking through this level will pave the way for further gains.

This scenario hinges on the Fed’s hawkish stance and a possible delay in interest rate hikes until at least Q3 2024, or fewer rate cuts than currently anticipated (expected three cuts of 25 bps).

This outcome is contingent upon inflation dynamics remaining stable and the economy avoiding a significant downturn.

USD/CHF Tests Key Resistance

Meanwhile, the USD/CHF currency pair has been on an upward trend since the beginning of the year, which gained momentum last week after the Swiss National Bank (SNB) decided to cut interest rates by 25 bps.

Currently, buyers are testing the supply zone around the 0.9 price mark.

USD/CHF Daily Chart

USD/CHF Daily Chart

All signs suggest that buyers will successfully surpass the specified area, paving the way for them to target higher levels around 0.9250, where the next significant peaks are located.

If a correction occurs, the market should focus on the support level around 0.89.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

For readers of this article, now with the code: INWESTUJPRO1 as much as 10% discount on annual and two-year InvestingPro subscriptions.

Subscribe Today!

Subscribe Today!

Disclaimer: