Nasdaq, S&P 500 Might Retreat Before Resuming Higher; Russell 2000 Eyes Breakout

US500

+0.32%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

+1.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

+1.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+0.20%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

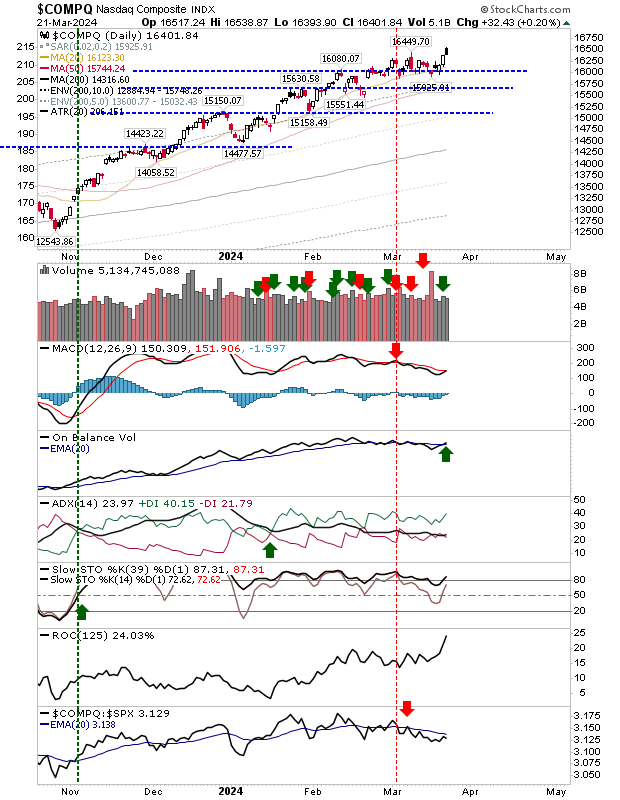

The Nasdaq started brightly but ended up closing below its open price but above the day before yesterday’s close. The S&P 500 did something similar, although the intraday range is narrower.

These two setups are somewhat complicated by the new ‘buy’ triggers in On-Balance-Volume for both the Nasdaq and S&P 500.

And the new MACD trigger ‘buy’ for the S&P 500. Price action is key, so I would expect the candlestick to trump the technical picture; watch for lower prices today.

COMPQ-Daily Chart

COMPQ-Daily Chart

The S&P 500 posted a relative bearish shift versus the Russell 2000 (IWM) but the trend is firmly bullish.

SPX-Daily Chart

SPX-Daily Chart

The Russell 2000 ($IWM) gapped higher but stalled out at resistance. As with peer indexes, there was an acceleration in On-Balance-Volume accumulation, but there is also the existing ‘sell’ trigger in the MACD.

The setup is not as bearish as for the Nasdaq and S&P 500, and there is potential for a breakout.

IWM-Daily Chart

IWM-Daily Chart

Given the relative divergence between action in the Russell 2000 ($IWM) and S&P 500 and Nasdaq, the probable net result will be a flat day where indexes go nowhere. Let’s see what the market brings.