Small Caps Poised to Keep Disappointing Investors Despite Rate Cut Projections

US2000

-1.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

-1.38%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWB

-0.23%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SMLF

-0.90%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The stock market is soaring and the rising tide has lifted small-cap shares, but if you’ve been expecting a hefty premium (or any premium) in smaller firms, well, there’s still plenty of disappointment to process.

There have been periods in recent years when small caps rallied and overtook their large-cap brethren in the performance horse race. But when you look through the short-term noise there’s still one clear result: the so-called small-cap premium has been elusive in recent years.

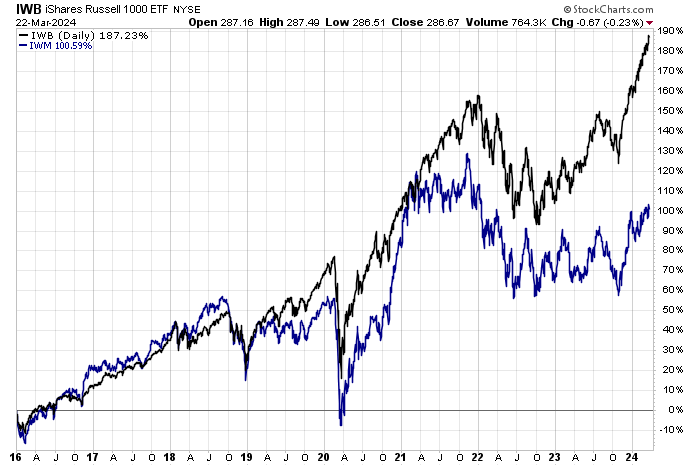

Consider the results since the end of 2015 based on a pair of widely held ETFs: the iShares Russell 1000 ETF (NYSE:IWB) has dramatically outperformed iShares Russell 2000 ETF (NYSE:IWM), a popular but deeply lagging small-cap ETF.

IWB-Daily Chart

IWB-Daily Chart

Small-caps in recent years have fallen well short of expectations that a risk premium in lesser companies would eventually deliver superior returns over the broad market, a.k.a. large-cap stocks. But one aspect of small caps that’s a hardy perennial: periodic revivals in forecasts that this lagging corner of the stock market is poised to run hot.

“Small caps ready for a comeback,” predicts Björn Jesch, global chief investment officer at DWS.

Focusing on European markets, he reasons in a research note last week:

“The magic of some mega cap stocks and the headwind of rising interest rates have had quite an impact on small caps since 2022. But the wind is slowly beginning to shift.”

In the US, investment advisors are focusing on small caps again, reports Investment News. A catalyst for taking a fresh look at this underperforming slice of equities is the relative strength in large caps, says Stephen Tuckwood, director of investments at Modern Wealth Management:

“Historically, when the Russell 1000 outperforms the Russell 2000 by around 20% over a 1-year period, it has been a compelling time to allocate to small caps on relative basis. Exact timing is always difficult but at some point, we anticipate that the two indices will begin to converge.”

Meanwhile, Fundstrat’s Tom Lee renewed his forecast for relative outperformance in the small-cap Russell 2000 Index.

“I think the [small-cap] Russell 2000 represents the best of things that happen when the Fed starts cutting,” he tells CNBC in an interview last week.

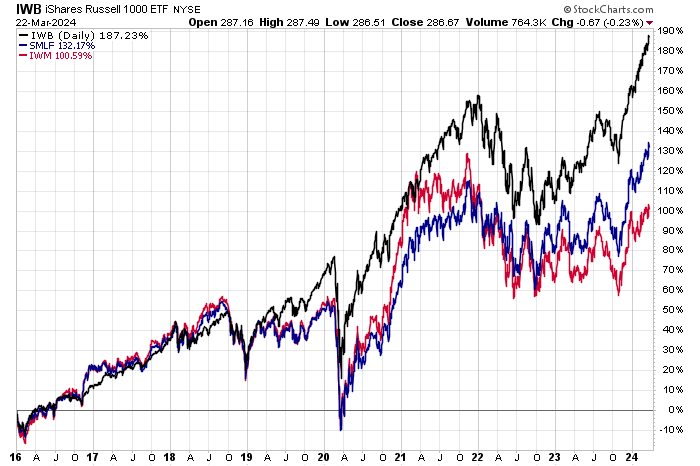

There’s also a school of thought that favors rethinking the standard approach to small-cap indexing as a superior tool for tapping into the small-cap premium. One example is the idea of building a small-cap footprint via a multi-factor framework a la iShares U.S. Small-Cap Equity Factor ETF (NYSE:SMLF) (SMLF), which has recently outperformed the conventional indexing strategy via iShares Russell 1000 ETF (IWB). IWB-Daily Chart

IWB-Daily Chart

But even SMLF has lagged large caps (IWB), and so the jury’s still out on whether small caps are finally poised to overtake the broad market. But one thing you can always count on in small-cap land: Hope springs eternal.