Stock Market Week Ahead: Core PCE, GDP to Test Fed’s Rate Cut Projection

WBA

-1.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CCL

+0.41%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- The Federal Reserve’s commitment to three rate cuts this year fueled a stock market rally to new highs.

- Anticipation is now building for the Initial Jobless Claims, U.S. GDP, and PCE Inflation data due next week.

- Apart from that, Investors will also be eyeing upcoming earnings from Walgreens and Carnival as well for clues on the market’s next direction.

- Subscribe to InvestingPro now for under $9 a month and never miss another bull market again!

It was a pivotal week for Central Banks around the world, with several important rates decisions shaking the investing landscape for the year ahead.

In what was considered a historic decision, the Bank of Japan hiked interest rates for the first time in 17 years, putting an end to the longest negative rates policy in history. However, as the market expected more hawkishness from the BOJ, the Japanese Yen tanked afterward the decision, reaching the key 150 level.

Conversely, the SNB cut rates in a surprise move on Thursday, making Switzerland the first developed nation to pivot in the current cycle.

In the US, the stock market surged to new highs following the Fed’s indication that it will maintain its projection for three interest rate reductions this year, despite stubborn inflation readings.

Investors are now giving an 80% chance to all three major central banks – the Fed, the ECB, and the BoE – to implement their first 25bps cut by June.

As the market continues to rally, savvy traders can collect eye-popping gains by following our predictive AI stock-picking tool. For less than $9 a month, ProPicks provides you with the top-performing companies in the market every month.

Subscribe now and never miss another bull market again by not knowing which stocks to buy!

Now let’s have a look at what investors should focus on for the week ahead.

1. Initial Jobless Claims

Attention is now turning to next week, particularly the Initial Jobless Claims report due on Wednesday. In an unexpected turn, the previous week saw a decrease in the number of Americans filing for unemployment benefits.

According to the Labor Department, claims for state unemployment benefits fell by 2,000 to a seasonally adjusted 210,000 for the week ending March 16, against economists’ expectations of 212,000.

Since February, claims have fluctuated within a range of 200,000 to 213,000. Despite significant layoffs at the beginning of the year, companies have generally retained employees, a trend attributed to the challenges of hiring during and post the COVID-19 pandemic.

2. U.S. GDP Revision

Investors will also keep an eye on the upcoming U.S. Gross Domestic Product (GDP) report’s revision for the fourth quarter, scheduled for release on March 28.

The GDP grew at a 3.2% annualized rate in the last quarter, a slight adjustment from the initially reported 3.3%, according to the Commerce Department’s Bureau of Economic Analysis’s second estimate for Q4 GDP growth.

3. PCE Inflation

Markets will be closed on Friday due to the Good Friday holiday in the US but we’ll still get some interesting data with the Fed’s preferred inflation measure – the Personal Consumption Expenditures (PCE).

Wall Street expects the February reading to be softer, which could support the Fed’s decision to lower rates in the coming months. Forecasts indicate that the core PCE price index will decrease to 0.3% month-over-month from 0.4%.

3. Walgreens Earnings

Walgreens Boots Alliance (NASDAQ:WBA) is set to announce its Q2 earnings for fiscal year 2024 on March 28, before the markets open. Analysts on Wall Street anticipate an EPS of $0.83 and revenues at $35.85 billion.

In Q1, Walgreens Boots Alliance reported earnings that exceeded analyst forecasts, driven by robust performance in its pharmacy operations and international business segments. The Illinois-based company, which has been attempting to slash costs to offset weaker discretionary spending by customers as well as lower contributions from COVID-19 vaccines and testing, also lowered its quarterly dividend by 48% to $0.25.

CEO Tim Wentworth described the dividend reduction as a “difficult” but necessary measure to “strengthen our long-term balance sheet and cash position.”

Since the announcement of Q1, the company’s shares plunged more than 17%.

Data from InvestingPro highlights a changing trend in analysts’ EPS forecasts for Walgreens Boots Alliance for the forthcoming quarter, with a sharp adjustment of -32.5% from an initial estimate of $1.23 per share to $0.83 per share over the past 12 months.

WBA Earnings Report

WBA Earnings Report

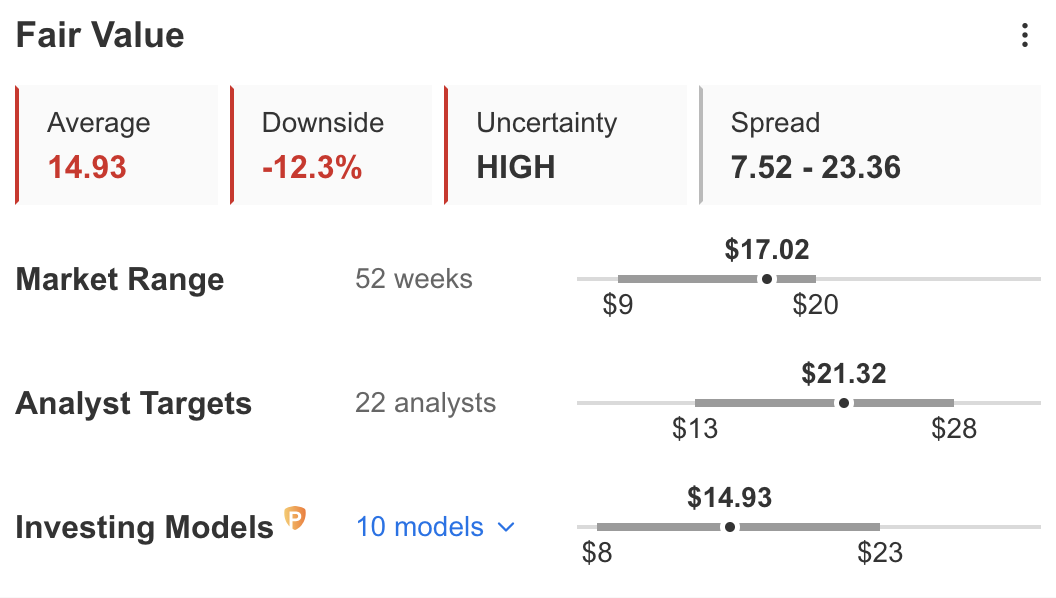

Despite the downward adjustment in EPS expectations, InvestingPro’s analysis on fair value suggests a potential upside of approximately 5.2% for the company’s stock price.

WBA Fair Value

WBA Fair Value

5. Carnival Earnings

Another company set to report its earnings is Carnival (NYSE:CCL). It is scheduled to release its Q1/24 earnings on Wednesday. Wall Street is predicting an EPS of ($0.18) and revenue of $5.4 billion for Carnival.

Earlier this month, Goldman Sachs initiated coverage on Carnival with a buy rating and a price target of $20.00. The analysis commented:

We see the setup for CCL into ’24 is most favorable, with CCL providing what we view as a conservative guide despite a larger occupancy recovery to come (higher Europe exposure) as well as 1) brand and late-stage revenue improvements and 2) manageable supply growth.

Contrastingly, our Fair Value assessment indicates that Carnival’s stock might be overvalued, projecting a potential decline of 12.4%. This is in stark difference to analyst price targets, which forecast an approximate 25% growth in stock price.

CCL Fair Value

CCL Fair Value

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Subscribe Today!

Subscribe Today!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Disclaimer: